Prorex PAMM Turns Everyday Traders into Portfolio Powerhouses

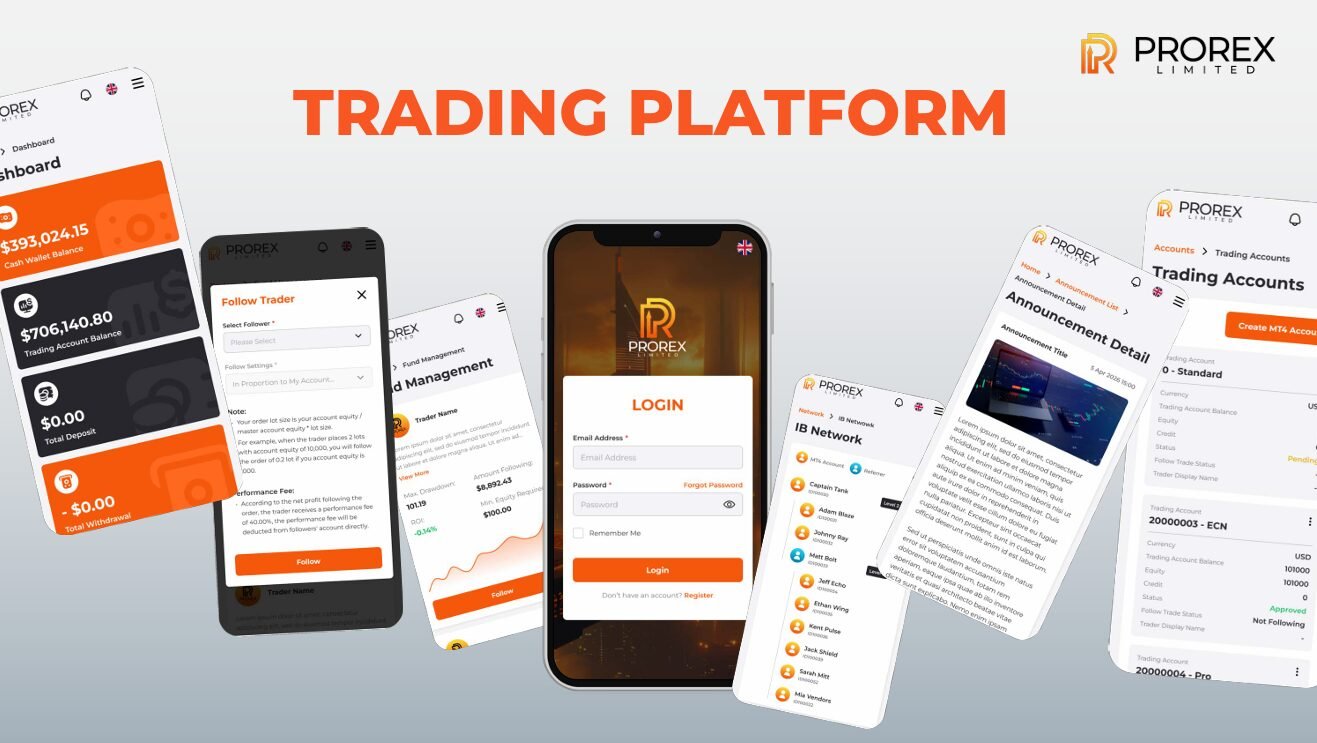

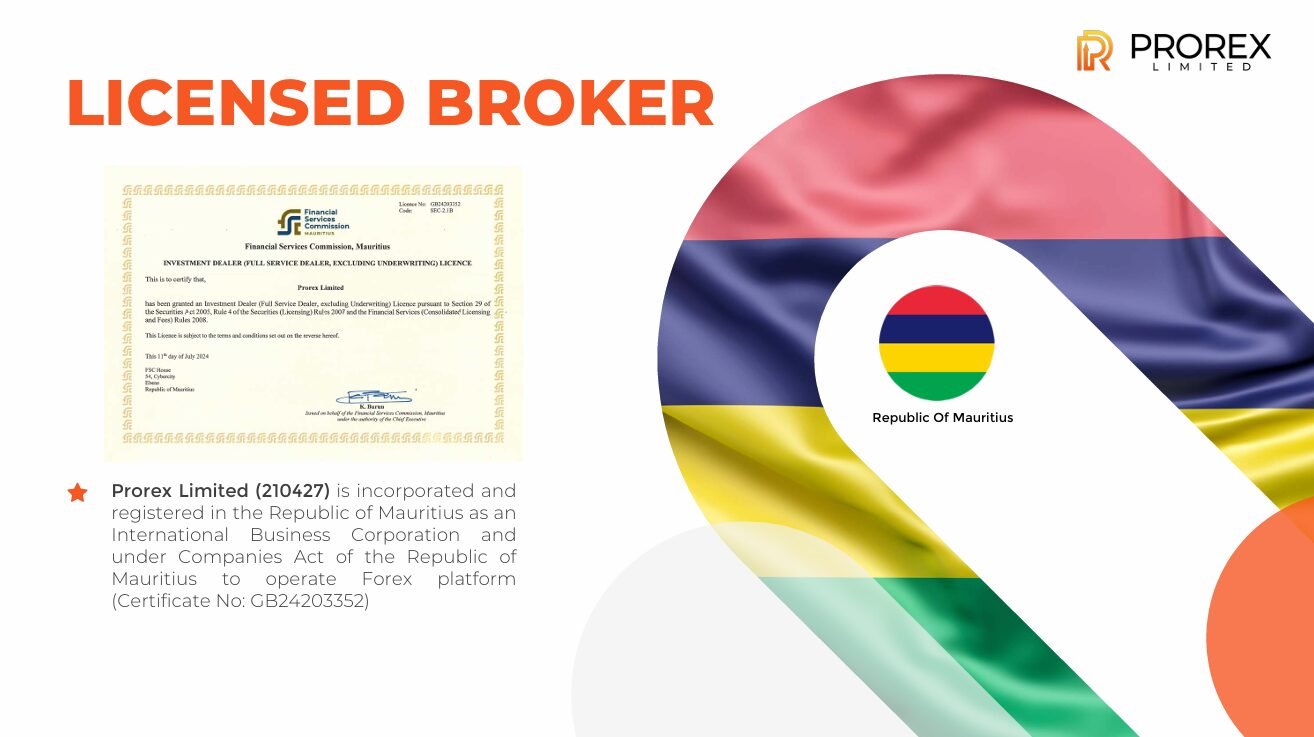

When people hear about managed accounts in online trading, assumptions often arise about hidden fees, lack of control, or limited transparency. Yet, systems like Prorex Pamm challenge these old beliefs. Instead of restricting investors, this platform combines technology, flexibility, and accountability, offering a clear case study of how managed trading is evolving in 2025.

Myth 1: PAMM Means Losing Control Over Your Funds

One of the most common misconceptions about PAMM accounts is that investors hand over control and lose visibility. In reality, Prorex Pamm trading demonstrates the opposite. Investors keep access to their accounts while allocations are managed through a transparent system that updates performance in real time. The platform allows investors to set allocations, track results, and even adjust their preferences without manual trading.

The ability to integrate Prorex AI trading, Expert Advisors (EAs), and flexible fee structures shows that control is not surrendered but rather enhanced. Traders benefit from Prorex low spread conditions, while investors can select their desired Prorex PAMM account minimum deposit, ensuring accessibility for beginners and scalability for professionals.

Myth 2: Copy Trading Is Just “Blind Following”

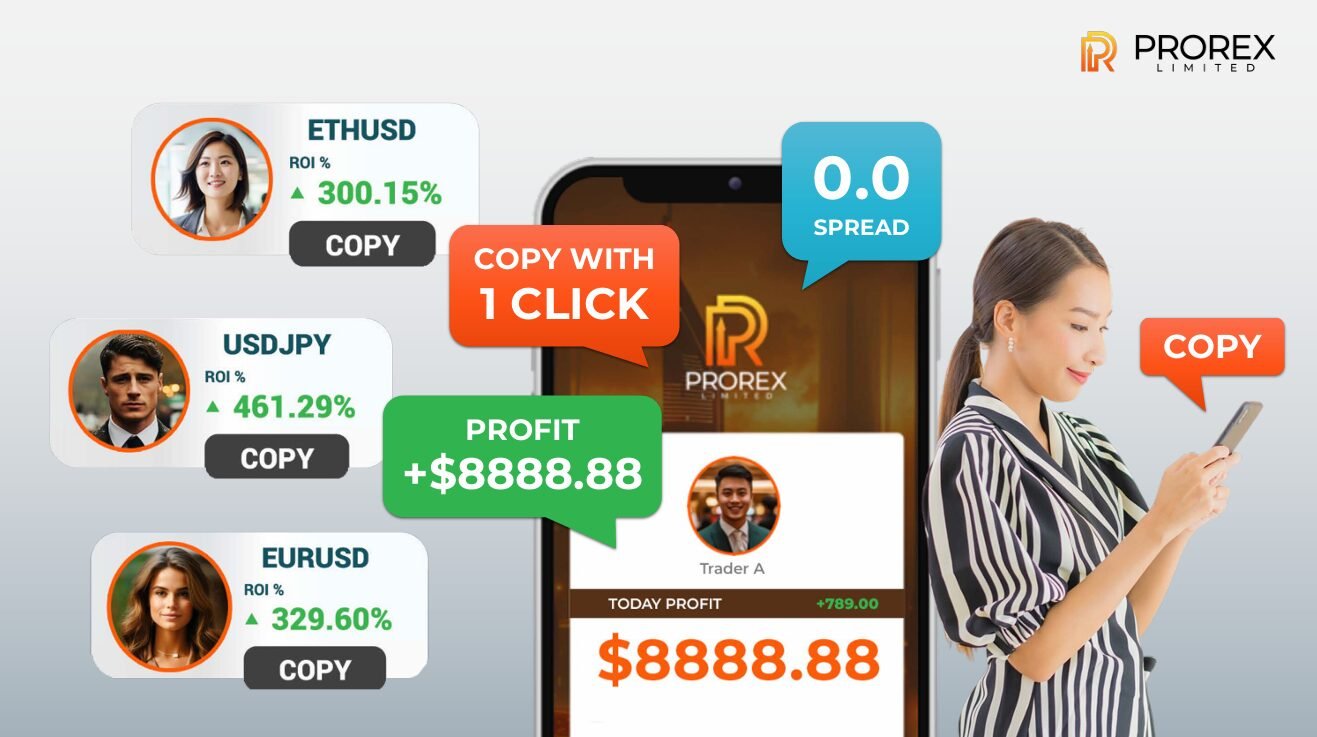

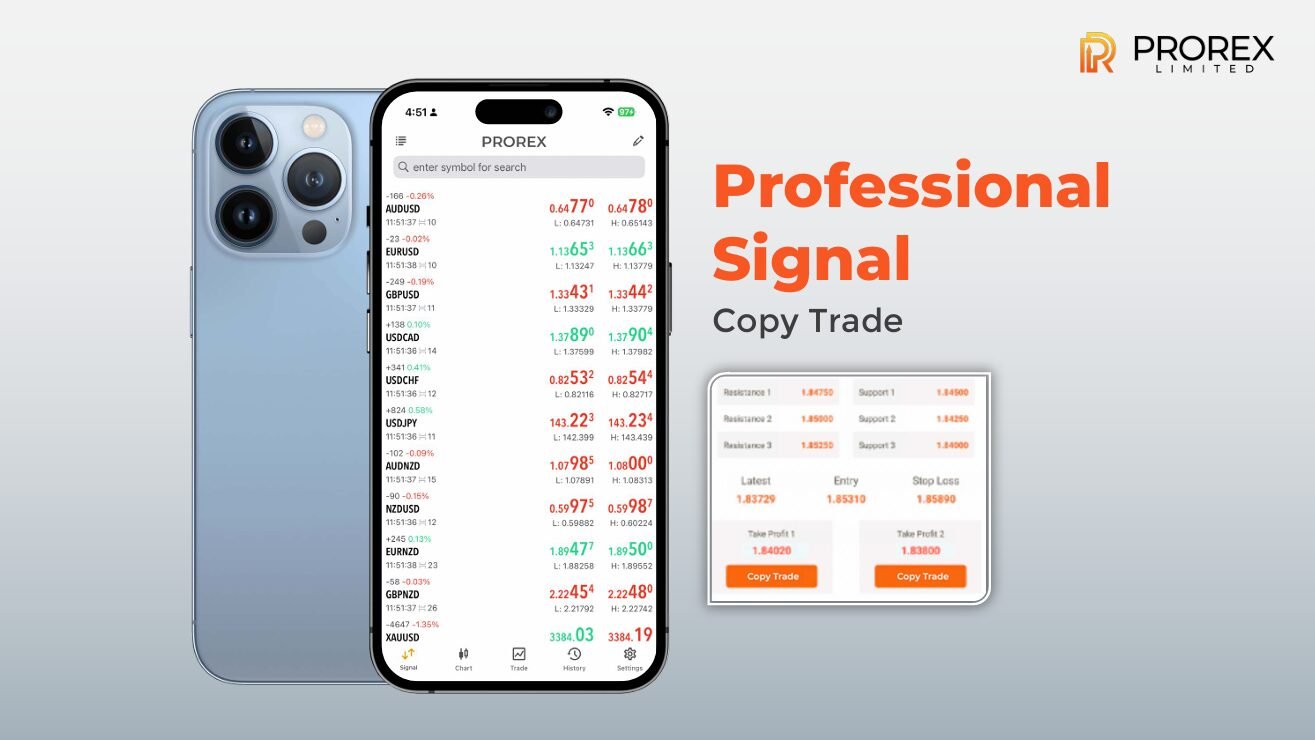

Another misunderstanding is that copy trading platforms simply encourage blind imitation. Case in point: Prorex copy trading integrates data-driven performance insights and strategy transparency. Investors can browse through hundreds of strategies, analyze track records, and then decide which trader to follow. This means the process is less about imitation and more about informed selection.

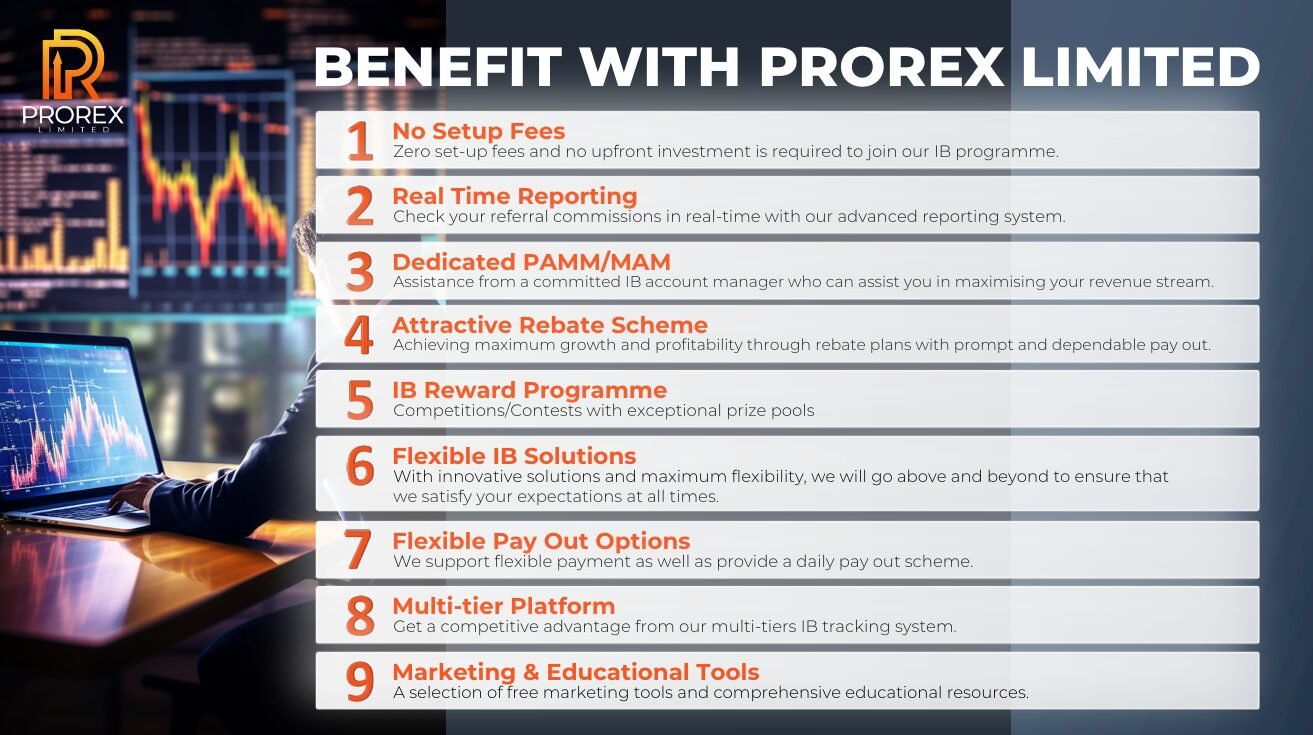

For strategy providers, the Prorex revenue share program creates a fair ecosystem, offering returns not just from trading profits but also from followers. Options like Prorex free credit and Prorex free bonus campaigns lower the barrier of entry for new participants, while experienced traders can grow their networks through published strategies. This layered approach transforms copy trading into a structured form of diversification rather than a gamble.

Myth 3: Prorex PAMM and MAM Are Outdated in 2025

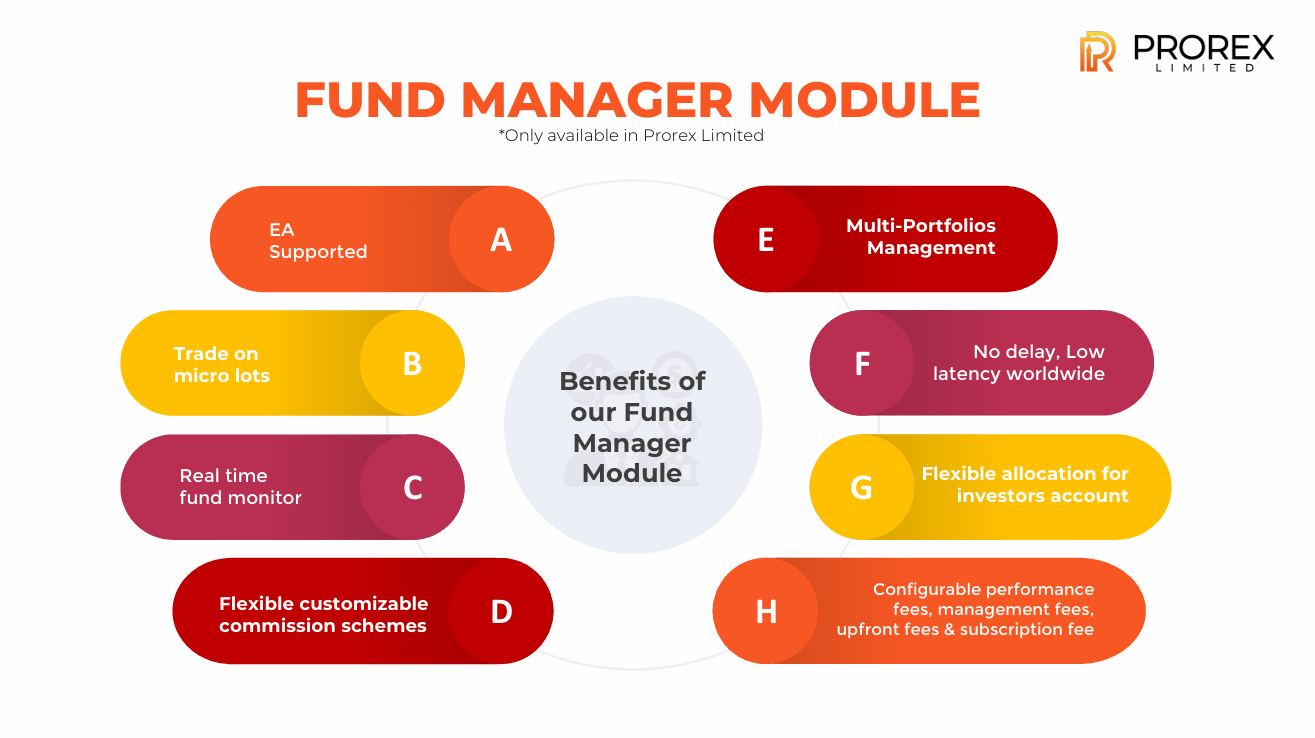

Some believe that PAMM investment platforms and multi account manager (MAM) systems are relics in a world dominated by automation. Yet, the tools offered by Prorex show otherwise. With Prorex indicators, customizable allocation methods, and low-latency global execution. The system adapts to modern trading conditions while maintaining the reliability investors expect.

The combination of Prorex PAMM system features and the multi account manager (MAM) module makes it possible for fund managers to oversee multiple portfolios seamlessly. Configurable fee structures—ranging from performance fees to subscription-based models—show that managed accounts are not outdated but instead increasingly relevant. This flexibility is one of the reasons why Prorex is discussed as a contender among the best PAMM brokers 2025.

Conclusion: Rethinking Prorex PAMM in Modern Trading

By examining these myths, it becomes clear that Prorex Pamm is not about giving up control. Blindly copying others, or relying on outdated systems. Instead, it is about merging transparency with adaptability, allowing both traders and investors to benefit from structured, technology-driven solutions. In a competitive industry, Prorex demonstrates how managed accounts can evolve without compromising choice. Making it an important case study in the shifting dynamics of online trading.Register PROREX member NOW! Click HERE

【 Prorex Limited 】

Official Website:Prorex Limited

General Support and Inquiries:Support@Prorex.Asia

Finance Inquiries:Finance@Prorex.Asia