Unlock God-Mode in the Markets: Are Prorex Trading Signals the Ultimate Cheat Code for Traders?

In today’s financial markets, we’re not facing an information shortage; we’re facing an information overload. The modern trader is inundated with a constant stream of data, from micro-second price fluctuations to global macroeconomic news. The true competitive edge, therefore, is no longer just access to information, but the ability to process it and extract actionable intelligence. This is where the next generation of trading tools comes into play. We are shifting from manual analysis to technologically-assisted decision-making, and sophisticated systems like Prorex trading signals represent this evolution. They are engineered to parse market noise and deliver distilled, data-driven insights directly to the user, effectively upgrading the trader’s operational capacity.

Content

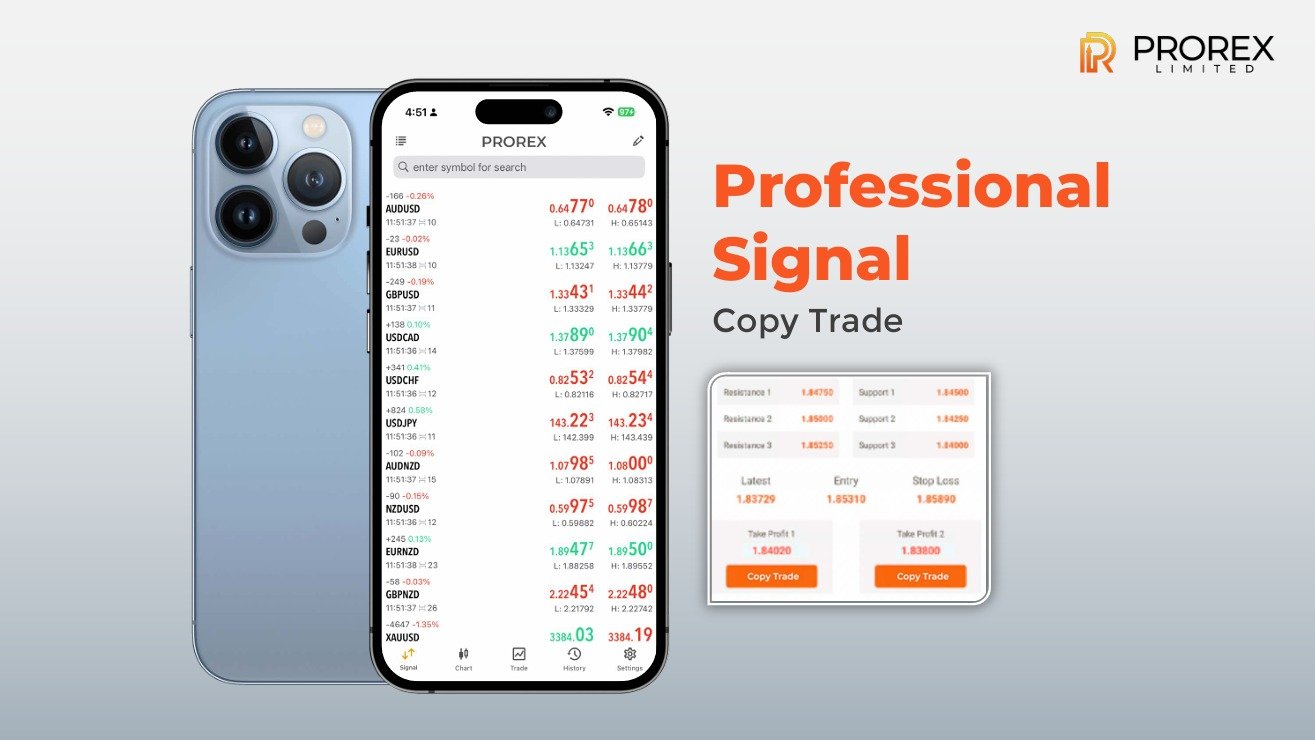

Deconstructing the Algorithm: How Prorex Trading Signals Function

At its core, think of the engine behind Prorex trading signals as a powerful data-processing unit. This system continuously runs complex algorithms that analyze multi-faceted datasets in real-time—chart patterns, volatility metrics, and a suite of technical indicators. The output of this computational process is a stream of prorex signals, which are high-probability trade setups delivered with clear entry and exit parameters. This technology is seamlessly integrated into the native Prorex trading platform, designed to minimize latency between signal generation and potential execution. The primary value proposition here is efficiency; it automates a resource-intensive analytical process, freeing up the trader’s cognitive bandwidth to focus on higher-level strategy and risk management.

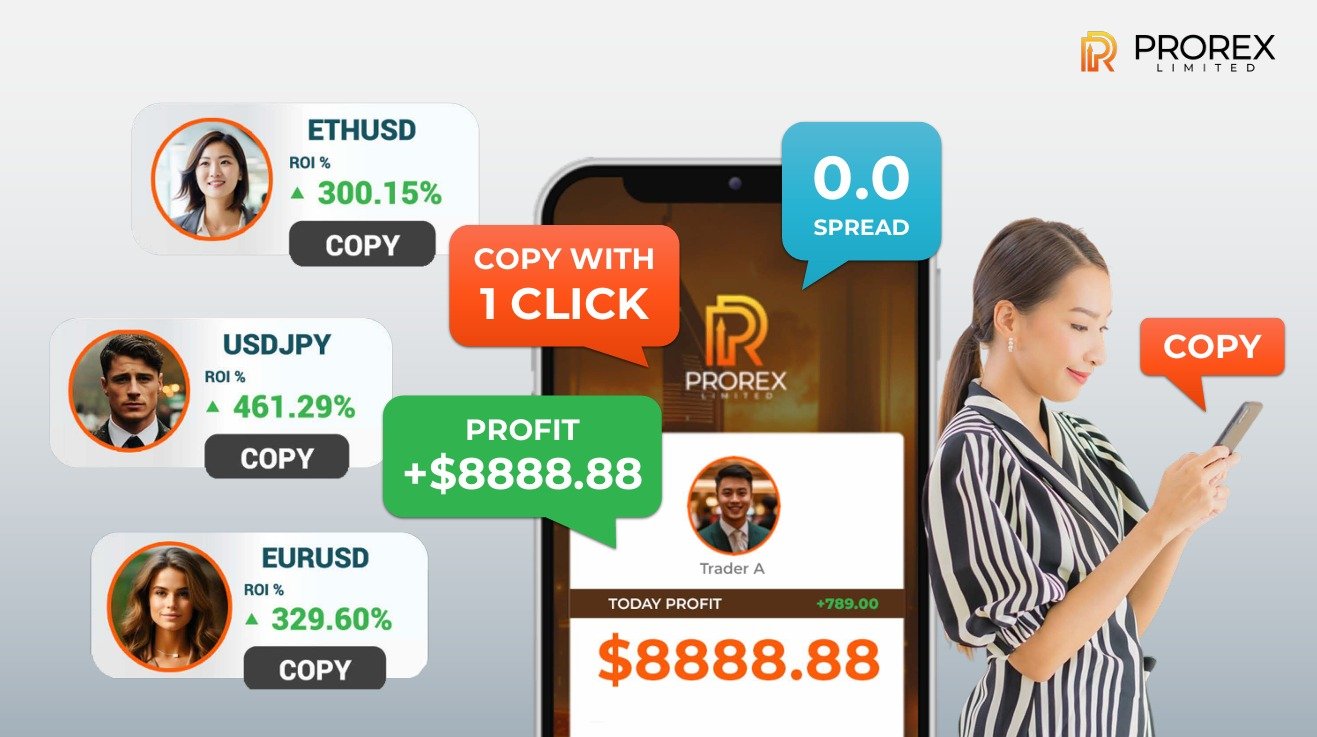

System Integration: Architecting Prorex Forex Signals into Your Workflow

A common misconception is to view trading signals as an autonomous solution. The sophisticated trader, however, views them as a powerful API (Application Programming Interface) that feeds into their broader trading system. The optimal way to leverage Prorex forex signals is to integrate them into your personal workflow as a validation or discovery tool. When a signal is generated, it should trigger your own strategic checklist. Does it align with your macro view of the market? Does it fit within your risk parameters? This process of “signal confluence” enhances the robustness of your prorex online trading decisions. Every prorex investment becomes a calculated move, backed not just by the system’s data, but by your own strategic architecture.

The Core Infrastructure: Platform Specs for Optimal Performance

Even the most advanced software is only as good as the hardware it runs on. In trading, the platform is your hardware. For signals to be effective, the underlying infrastructure must be optimized for performance. Key performance indicators (KPIs) for the trading environment include a consistently low prorex spread, which directly impacts execution costs and profitability. A critical system specification is robust prorex regulation, which functions as a security protocol for your capital. Furthermore, a flexible prorex account structure allows you to tailor the environment to your specific strategic needs. While incentives like a prorex trading bonus can provide marginal utility, the core focus for any tech-savvy trader should be on the platform’s stability, speed, and security—the foundational elements that ensure your system operates at peak efficiency.

Upgrading Your Trading OS for 2025 and Beyond

To stay competitive, traders must continuously upgrade their personal “Operating System”—their methods, tools, and strategies. Integrating a data-driven tool like Prorex trading signals is a significant system upgrade. It represents a move away from purely discretionary, intuition-based trading towards a more hybrid model that leverages the power of algorithmic analysis. As we look toward the landscape of the Best forex signal providers 2025, the leaders will be defined by their technological prowess. The ultimate goal is to build a cohesive, efficient, and intelligent trading ecosystem, and leveraging advanced signals is a critical component of that future-proof architecture.

Register PROREX member NOW! Click HERE

Official Website:Prorex Limited

General Support and Inquiries:Support@Prorex.Asia

Finance Inquiries:Finance@Prorex.Asia