The Hidden Engine of Passive Income? Inside Prorex Pamm Trader

When people first hear about Prorex Pamm Trader, many assume it’s just another buzzword in the forex world. The truth is, PAMM accounts have long been misunderstood. Some see them as too complex, others think they guarantee profits, and a few even confuse them with copy trading. In reality, the Prorex model blends transparency, regulation, and technology to offer a structured approach to portfolio management. Let’s break down some common myths and uncover what’s actually happening behind the scenes.

Myth 1: Prorex Pamm Trader Is Just Copy Trading in Disguise

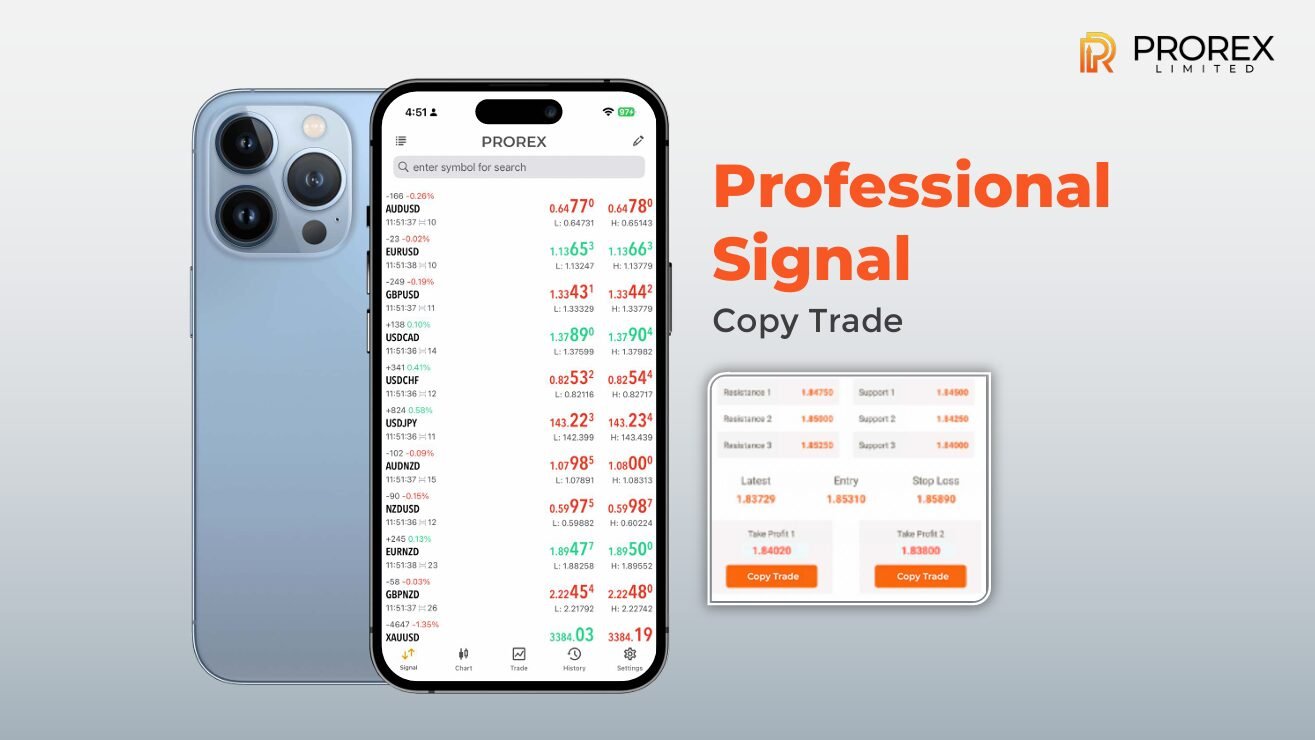

It’s easy to see why this assumption exists—both systems involve following experienced traders. But Prorex Pamm Trader is not the same as copy trading. With copy trading, followers mirror trades one by one in real time. PAMM, on the other hand, pools investor funds and allocates profits and losses proportionally. This means the risk and reward are shared fairly, based on the amount invested.

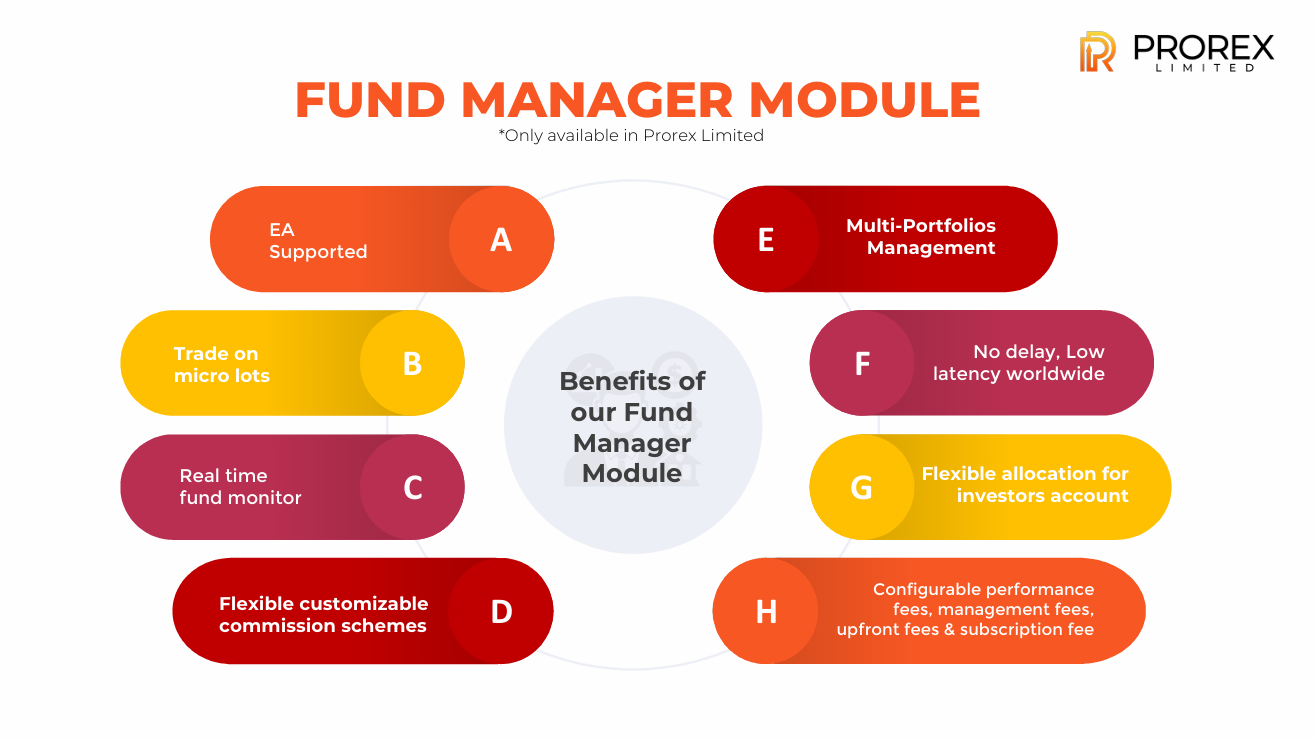

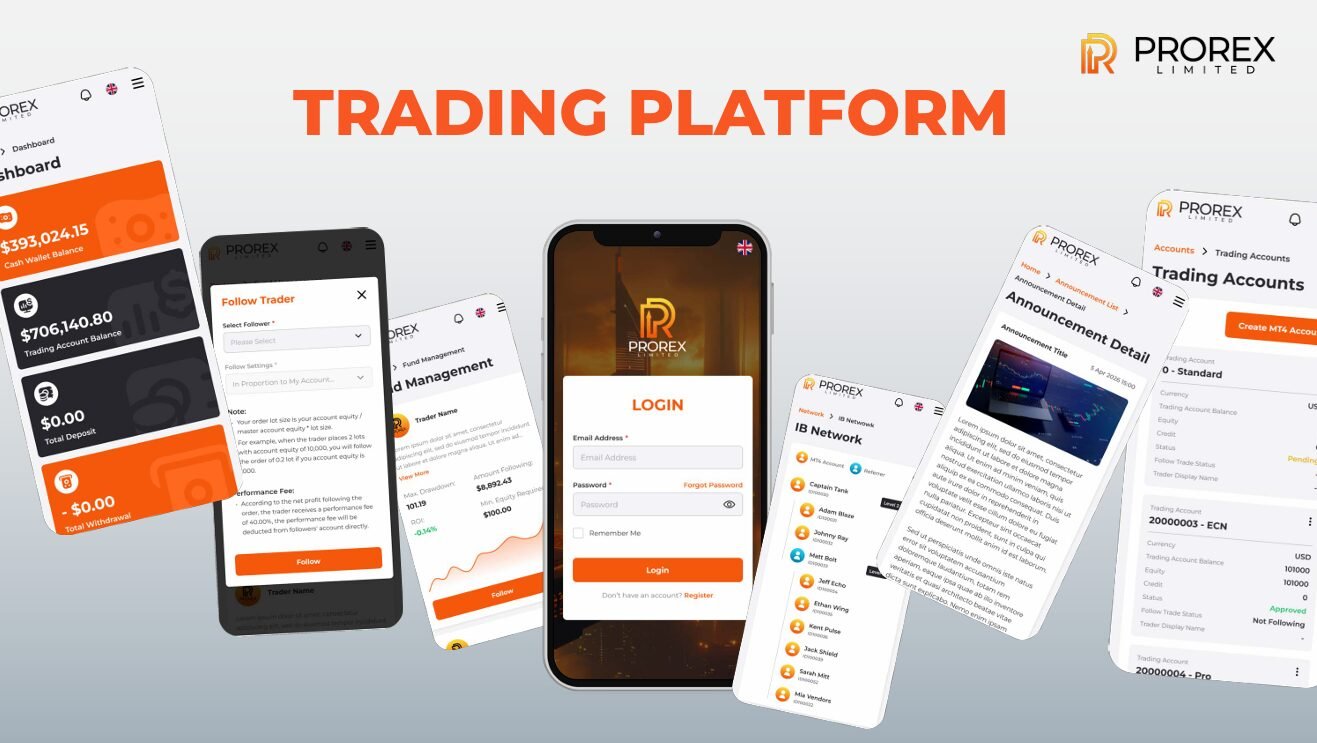

Prorex Limited supports both models, but PAMM accounts are tailored for those who prefer structured allocation with customizable performance fees and real-time reporting. The added advantage of using MetaTrader 5 and expert advisor (EA) compatibility makes it far more versatile than the casual “copy-paste” perception.

Myth 2: PAMM Accounts Are Risk-Free Investments

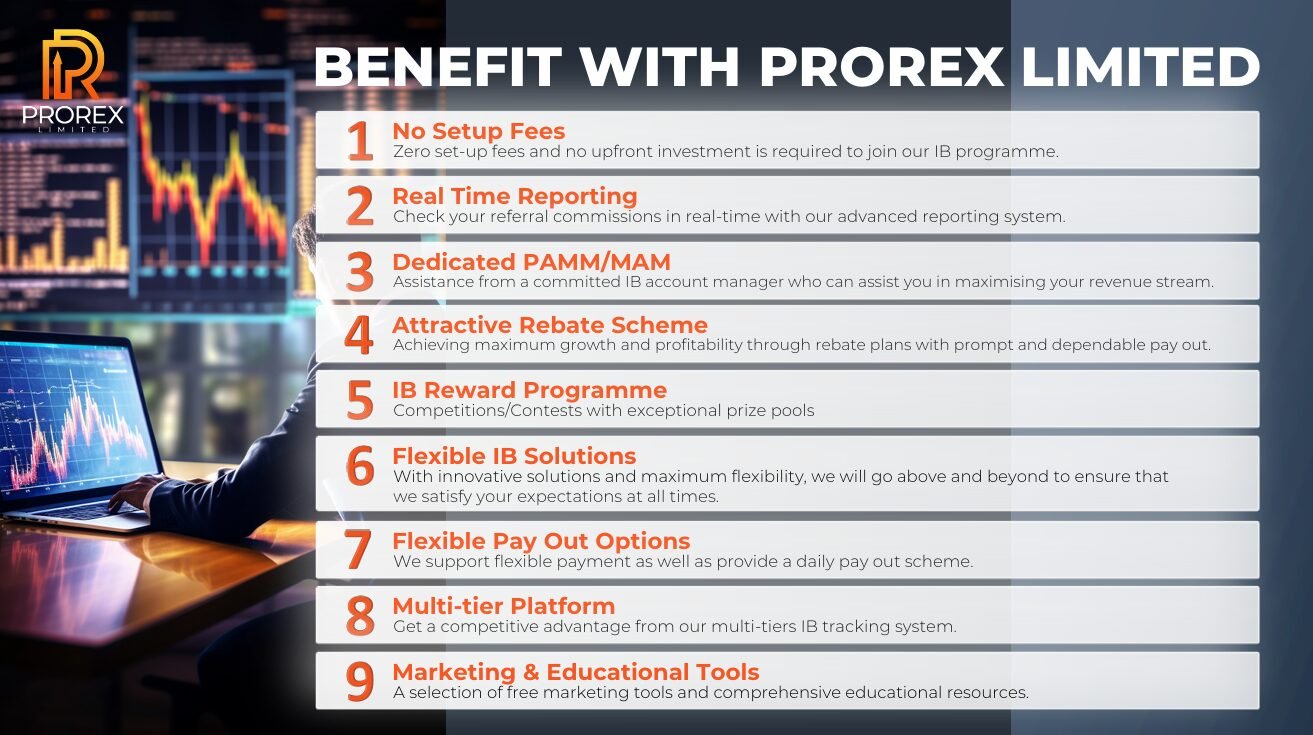

Another widespread belief is that PAMM accounts deliver consistent profits with little to no risk. In practice, all trading carries market exposure. The difference lies in how the risk is managed. Through Prorex Pamm Trader, investors can review fund managers’ track records, compare performance histories, and set allocations accordingly. The platform allows transparency in fee structures—management fees, subscription costs, or performance charges are clearly outlined from the start.

By providing ultra-low spreads, fast execution speeds, and regulated oversight under the Mauritius FSC, Prorex reduces operational risks, but it doesn’t remove the inherent nature of market volatility. What it does offer, however, is a way for investors to participate intelligently with full visibility on their chosen manager’s strategy.

Myth 3: Prorex Pamm Trader Is Only for Professionals

The final misconception is that PAMM accounts are only suitable for seasoned investors or fund managers. While professional traders often act as strategy providers, Prorex has designed its system to be accessible for both sides. Investors with smaller deposits can still join a PAMM account, diversify their exposure across different managers, and track results in real time.

For strategy providers, the benefits are equally clear. Prorex’s module allows fund managers to set bespoke conditions, from performance fees to trading parameters, and have their strategies listed on a leaderboard to attract followers. This creates a dynamic ecosystem where professional knowledge meets everyday investor interest—bridging the gap between expertise and accessibility.

Conclusion: Why Prorex Pamm Trader Stands Out

Looking at these myths, it becomes clear that Prorex Pamm Trader is not just another trading gimmick. It is a regulated, transparent, and flexible framework for investors seeking structured exposure to the forex market. By debunking misconceptions around copy trading, risk, and accessibility, Prorex demonstrates how PAMM accounts can offer real opportunities—without making unrealistic promises. In today’s fast-paced financial environment, that balance of innovation and integrity is what sets it apart.

Register PROREX member NOW! Click HERE

Official Website:Prorex Limited

General Support and Inquiries:Support@Prorex.Asia

Finance Inquiries:Finance@Prorex.Asia