Gold Hedge Rupiah: The Quiet Risk to Your Savings Most Indonesians Overlook

Gold hedge rupiah: Let’s be honest — many of us still have all our savings in rupiah, assuming the currency will hold steady. But what happens when it doesn’t?

With global uncertainty and regional shocks in the mix, the rupiah has once again shown how fragile it can be. And while most people worry after the damage is done, those using a gold hedge rupiah strategy are already one step ahead.

This isn’t about fear. It’s about preparation. And ignoring this growing risk could quietly shrink your wealth.

Risk 1: Rupiah Depreciation Has Already Started — Are You Ready for More?

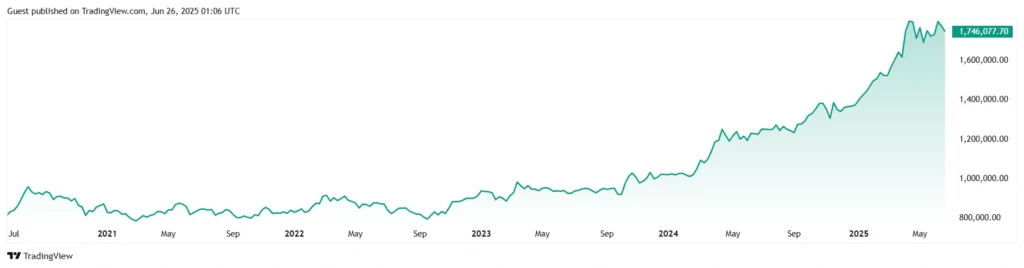

Source: TradingView

2025 has already seen multiple dips in the rupiah — triggered by rising global interest rates, trade tensions, and inflation pressures. Each time, those holding gold saw their IDR-based gold value rise.

If you’re still holding all your savings in rupiah, you’re fully exposed. Any further weakness could chip away at your buying power — and fast.

Risk 2: Gold hedge rupiah- Gold Prices React Faster Than You Think

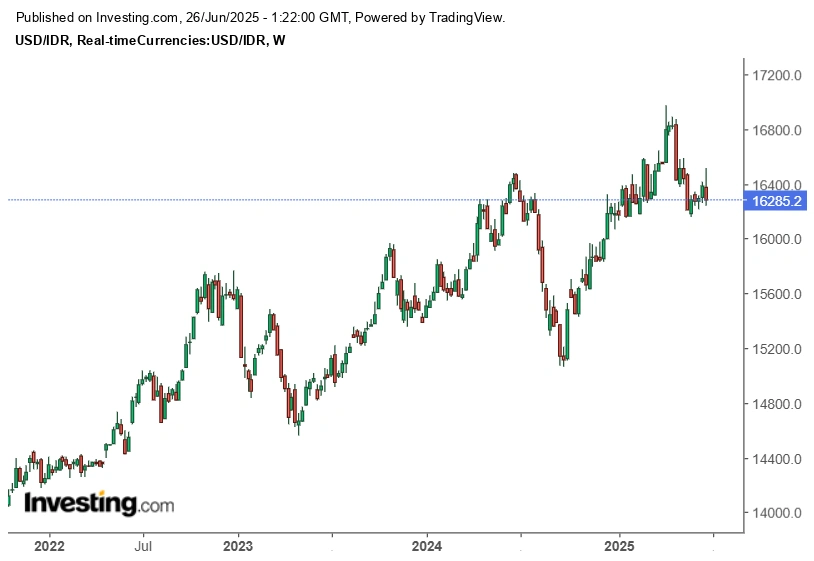

Source: Investing.com

By the time the media starts talking about a weakening currency, gold prices have usually already moved.

It’s not uncommon to see gold in Indonesia spike within days of major rupiah news. Waiting for “the right moment” might mean you’re buying at the top — or worse, buying too late to protect your money.

Risk 3: Gold hedge rupiah- Inflation Plus Weak Currency Means Double Pressure on Your Savings

Not only is the rupiah under stress, but inflation is quietly eating away at your cash. If your money is sitting in a basic account earning low interest, it’s likely losing real-world value month after month.

Gold doesn’t pay interest, but in times like these, it holds purchasing power — and that’s the whole point of a gold hedge rupiah plan.

Why Gold Works in Times of Local Currency Stress

Gold is traded globally, in US dollars. So when the rupiah falls, gold priced in IDR tends to rise. Even if global gold prices stay flat, your local value increases — giving you a buffer.

And the best part? You don’t need to buy a vault’s worth of gold to get started. Digital gold apps in Indonesia let you hedge with as little as 0.1g — making this strategy accessible to almost anyone.

Simple Ways to Build Your Gold Hedge Today

Getting started doesn’t require a financial advisor. Here’s what others are doing:

- Using digital apps like Pluang, Tokopedia Emas, or Lakuemas to buy small amounts

- Purchasing physical gold from Antam or Pegadaian — stored safely at home or in bank deposit boxes

- Investing in gold ETFs or gold-backed funds if they already use online brokerages

Whatever you choose, just make sure it’s something you can access easily if you need to liquidate quickly.

Final Warning: Waiting Carries More Risk Than Action

A common myth is that gold is too expensive or too complicated. The truth? Doing nothing is riskier.

You don’t need to convert all your assets — even hedging 10% to 15% of your savings in gold can make a big difference. A gold hedge rupiah approach is meant to protect — not replace — your overall financial plan.

The Bottom Line

The signs are already flashing — currency dips, rising prices, and a jittery global market. If you’re hoping it’ll all blow over, you’re gambling with your savings.

The gold hedge rupiah strategy exists for moments like this. Don’t wait for the headlines to tell you it’s time — by then, the smart money will have already moved.