2025 Brings Stricter Rules, Greater Clarity for Traders

Forex regulation Indonesia: The landscape of forex trading in Indonesia continues to evolve, and 2025 is proving to be a pivotal year. Authorities have strengthened their focus on forex regulation, aiming to curb illegal trading activity and ensure investors operate within safer legal boundaries.

Increased public interest, combined with the rise of mobile trading apps and international broker access, has pushed regulators to reassert control. While forex trading remains legal in Indonesia, it now comes with stricter compliance expectations — especially around broker licensing and investor protection.

The shift isn’t just legal—it’s cultural. The government wants forex to be viewed not as a shortcut to quick wealth, but as a serious financial activity governed by clear standards.

Forex regulation Indonesia: Bappebti and OJK Push for Stronger Market Supervision

Source: tvonenews

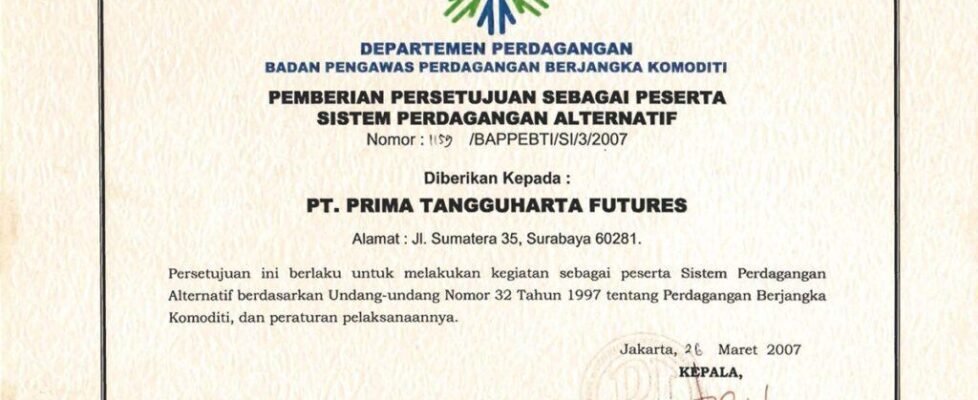

In the Indonesian forex ecosystem, Bappebti (Commodity Futures Trading Regulatory Agency) is the primary licensing body. Meanwhile, OJK (Financial Services Authority) provides broader oversight across financial behavior and marketing ethics.

In 2025, both agencies have stepped up enforcement. Bappebti now routinely monitors websites, social media channels, and affiliate influencers, taking down illegal forex content or unauthorized promotions. Dozens of domains have been blacklisted since the beginning of the year — and the list is still growing.

This effort signals a broader trend: Indonesia wants its traders to rely on licensed, accountable platforms—not offshore brokers operating in a legal vacuum.

Forex regulation Indonesia: Legal Brokers Gain Ground as Compliance Becomes Essential

For years, many forex traders in Indonesia opened accounts with international brokers without understanding the legal risks. But in 2025, that’s starting to change. Bappebti’s growing influence means local traders are now more aware of which platforms are legal — and why that matters.

Brokers that operate under a Bappebti license must meet minimum capital requirements, follow ethical advertising practices, and offer clear disclosures in Bahasa Indonesia. These are no longer optional checkboxes — they’re critical for doing business in the country.

As a result, compliance has become a competitive edge. More brokers are now seeking approval, while traders look for those who meet regulatory standards as a mark of trust.

Forex regulation Indonesia: Retail Traders Face a New Normal: Regulated, But Empowered

One noticeable shift in 2025 is how retail traders are approaching forex. The “wild west” era of trading with unverified platforms is fading, replaced by a stronger preference for transparency, education, and platform accountability.

While traders still want speed and access, they now prioritize safety. Many are using Bappebti’s public broker list as a reference before opening accounts. Others are more cautious about high-leverage offers or “guaranteed profit” claims, which regulators have flagged as warning signs of unlicensed activity.

The trend points to maturity: the Indonesian trading public is growing wiser, not just bigger.

Foreign Brokers Without a License Face Growing Limitations

Source: FXNEWSGROUP

Although some international brokers still serve Indonesian clients unofficially, their reach is narrowing. The government has started blocking their domains, flagging their ads, and issuing public warnings through financial authorities.

These actions are not symbolic — they directly affect access. In many cases, even experienced traders who once relied on offshore brokers are now switching to local options for peace of mind.

The message is clear: without a Bappebti license, you’re operating outside the legal trading space. That means no investor protections, no dispute channels, and no guarantee your funds are safe.

Digital Literacy and Regulation Go Hand in Hand

Indonesia’s regulatory bodies are not just enforcing rules—they’re also educating traders. In 2025, Bappebti and OJK have expanded their online campaigns to help people spot illegal brokers, recognize misleading promotions, and understand what makes a platform legal.

This emphasis on financial literacy is becoming a cornerstone of the country’s forex strategy. The belief is that informed traders are less likely to fall victim to scams, less likely to misuse leverage, and more likely to engage in forex responsibly.

It’s part of a wider vision: regulation isn’t just about penalties — it’s about preparing retail investors to participate in the market safely.

Looking Ahead: What Forex Traders Should Expect

Source: Keenanga

The direction is set. In 2025, Forex regulation Indonesia enforces is not just about policing — it’s about building a sustainable market. Traders can expect even more regulatory clarity in the months ahead, including tighter scrutiny of online promotions and affiliate marketing practices.

For brokers, the path forward is clear: get licensed or risk exclusion. For traders, the takeaway is equally straightforward — if your platform isn’t regulated by Bappebti, you’re taking unnecessary risks.

The Indonesian forex market isn’t shrinking — it’s growing up.