Vietnam Crypto Law 2025: New Rules, New Risks for Digital Asset Users

Vietnam Crypto Law 2025: New Rules, New Risks for Digital Asset Users

As Vietnam’s crypto law takes full effect in 2025, the country finds itself in a transitional moment. The legislation introduces long-awaited structure through VDA rules—defining how digital assets can be traded, issued, and licensed. But clarity doesn’t come without consequences. For investors, exchanges, and startups, the new framework also raises real and immediate concerns.

Risk 1: Unlicensed Platforms May Be Forced Offline

Under the 2025 law, all platforms dealing with Virtual Digital Assets (VDAs) are now required to secure operational licenses through the Ministry of Finance. The process comes with stringent conditions, including capital thresholds, data protection compliance, and transparency protocols.

Unlicensed platforms—particularly foreign exchanges still serving Vietnamese users—face potential operational shutdowns or blacklisting. Already, some local traders have reported access issues as quiet enforcement begins to take hold behind the scenes.

Risk 2: Retail Users Face Tighter Controls on Trading in Vietnam Crypto Law 2025

Credit from Datawallet

Although crypto trading in Vietnam now enjoys a clearer legal definition, the experience for users is changing. Platforms must implement KYC checks, anti-money laundering measures, and detailed transaction monitoring.

This means identity verification is now mandatory for all users. The use of anonymous wallets may raise red flags, and certain limits may apply to unverified accounts. For many Vietnamese traders accustomed to fluid, unrestricted access, this marks a significant shift.

Risk 3: Licensing Requirements Could Shrink Startup Participation

The law’s VDA licensing requirements in Vietnam are praised by regulators for bringing legitimacy to the market. However, they present real obstacles for smaller startups. New entrants must now demonstrate financial solvency, conduct regular audits, and maintain robust cybersecurity infrastructure.

As a result, the cost of compliance could push emerging blockchain projects toward jurisdictions with fewer entry barriers—potentially slowing local innovation and reducing diversity in the Vietnamese crypto space.

Risk 4: Unclear Taxation Policies Still Cloud the Horizon in Vietnam Crypto Law 2025

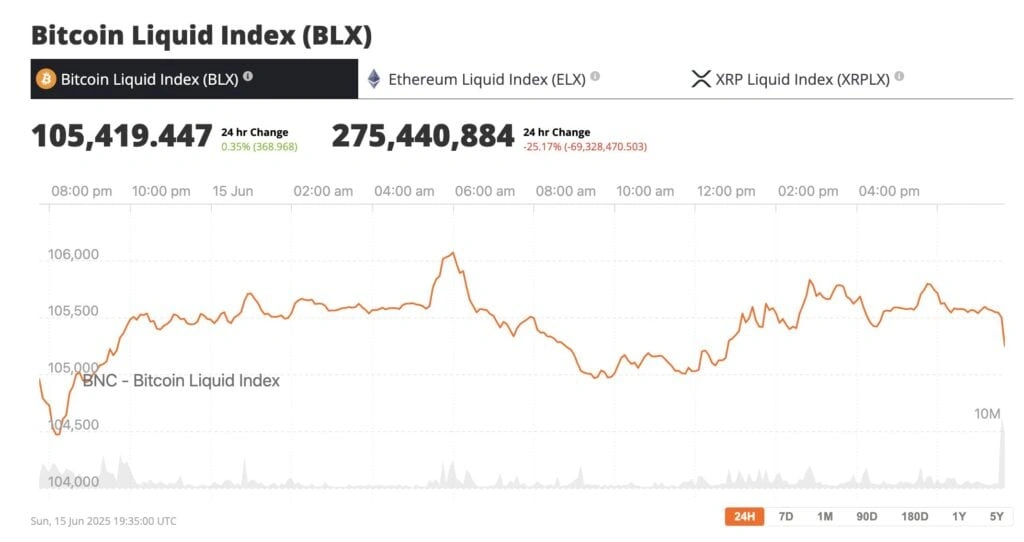

Credit from Brave New Coin

While the 2025 law creates a firmer legal footing for crypto, taxation remains murky. The government is expected to clarify rules on capital gains taxes for digital assets, but until then, traders face significant uncertainty.

Questions linger over how crypto income should be classified, what reporting standards apply, and how assets are valued for tax purposes. Without consistent guidance, those with high trading volume or large holdings remain exposed to potential compliance missteps.

Risk 5: Market Liquidity May Drop During Regulatory Transition

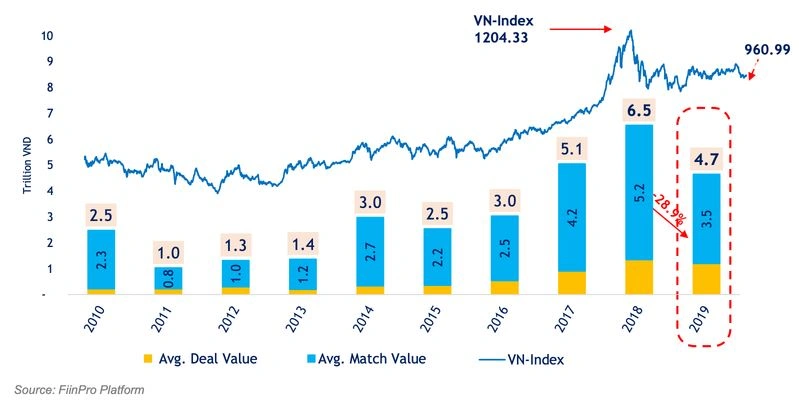

Credit from FiinGroup

In the initial months of the law’s rollout, some traders and investors have noticed thinner markets. As exchanges pause services to complete licensing applications, and users move assets due to caution, liquidity has temporarily declined.

This has led to wider spreads and higher slippage—especially for lower-volume tokens. Smaller altcoins, in particular, are feeling the pinch, as market participation dips during this period of adjustment.

Risk 6: Potential Overreach in Surveillance and Data Access

Another concern among crypto users is the expanded surveillance capacity introduced under the law. As part of anti-money laundering enforcement, authorities can request detailed transaction records and personal data from exchanges.

This raises alarms among privacy advocates, who fear the possibility of government overreach. Without strong checks and transparent appeal processes, there’s anxiety that this aspect of enforcement may be used too broadly or punitively.

Risk 7: A Two-Tier System Between Licensed and Unlicensed Assets

The law also formalizes a distinction between “approved” and unapproved digital assets. Only tokens vetted through Vietnam’s official regulatory pipeline can be traded on licensed platforms. This creates a split market landscape.

Licensed tokens will enjoy legal backing and exchange support, while unlicensed ones may remain technically accessible—but without regulatory protection. Some traders may still seek access to unlisted tokens via offshore platforms, risking counterparty exposure or running afoul of the law.

Conclusion: The Vietnam Crypto Law 2025 Brings Order—but Also New Friction

The Vietnam crypto law and newly implemented VDA rules mark a turning point for digital assets in the country. While they bring needed structure and legitimacy, the trade-offs are evident. From licensing barriers and surveillance concerns to taxation uncertainty and liquidity dips, Vietnam’s journey toward a fully regulated crypto market is not without turbulence.

As the system matures, stakeholders across the crypto ecosystem—users, developers, exchanges—will need to adapt, cautiously but proactively. In this evolving landscape, staying informed may be just as important as staying compliant.