Rupiah Forecast 2025: Can Indonesia’s Currency Stay Afloat Amid Shifting Global Tides?

The Outlook in Focus: Rupiah at a Pivotal Moment

The Rupiah Forecast 2025 lands in a landscape full of contradictions. On one hand, Indonesia continues to show steady economic performance, thanks to ongoing infrastructure development, rising domestic consumption, and a central bank committed to managing inflation. On the other hand, the global macro environment remains volatile. Emerging markets are still adjusting to years of monetary tightening, geopolitical friction, and slowdowns in key trade partners like China. This dual reality places the IDR in a delicate position — not in immediate danger, but also not shielded from turbulence. The question isn’t just where the Rupiah is headed, but how long it can hold its current ground.

U.S. Dollar Strength Still Looms Large

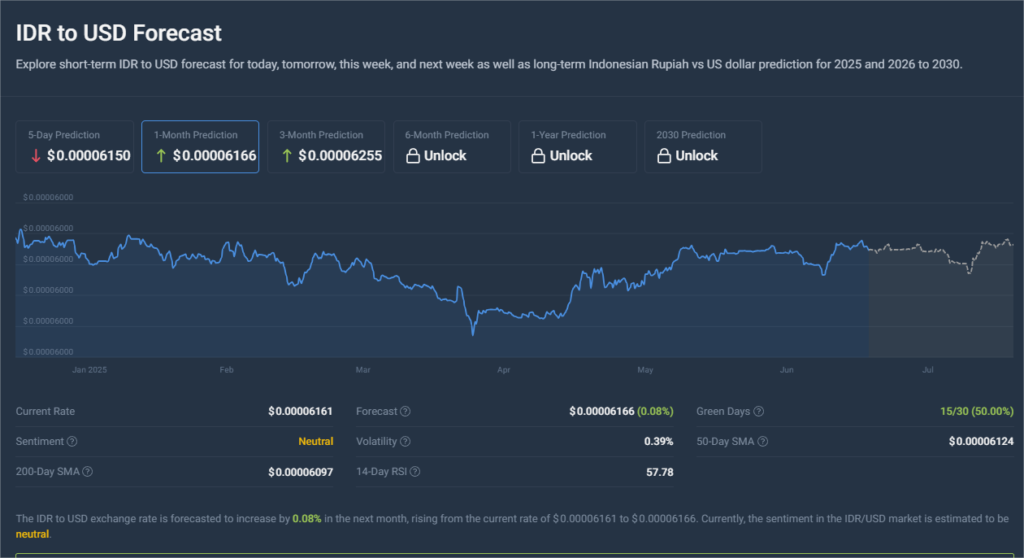

Source: Coincodex

One of the defining external factors in the Rupiah forecast 2025 remains the U.S. dollar. Despite expectations that the Federal Reserve may begin easing rates by the second half of the year, the dollar has remained firm on the back of resilient U.S. labor data and sticky inflation. A strong dollar typically leads to capital flowing out of emerging markets and back into U.S. assets. For the Rupiah, this dynamic creates an uphill battle — even when Indonesia’s fundamentals are in decent shape. The longer the Fed maintains its cautious stance, the more pressure currencies like the IDR will face to remain competitive.

Trade and Commodity Exports: A Source of Relief — or Risk?

Indonesia’s trade performance has historically served as a buffer during times of global stress. In recent years, exports of coal, nickel, and palm oil have helped build a solid current account position. But the Rupiah outlook 2025 could be vulnerable if these trade flows begin to weaken. China’s slowdown and growing restrictions on key resources may dampen demand, while softer prices could trim revenue. At the same time, imports could climb if domestic growth accelerates — narrowing the trade surplus. If the gap between foreign earnings and outflows grows too tight, the Rupiah could find itself more exposed to short-term speculative pressures.

Rupiah Forecast 2025: Domestic Growth Remains a Pillar — But With Caveats

Despite global headwinds, Indonesia’s internal economic picture remains relatively strong. GDP growth is projected to stay around 5% in 2025, supported by consumer demand and a maturing digital economy. However, inflation control remains a delicate issue. While Bank Indonesia has been successful in containing inflation within its target range, rising energy costs and food imports could put new pressure on price stability. In this context, the Rupiah forecast is tightly linked to policy credibility. If inflation expectations rise or policy responses seem delayed, the currency could see sudden corrections — even in the absence of major external shocks.

Rupiah Forecast 2025 : Bank Indonesia’s Role in Signaling Confidence

Source: Bloomberg

Bank Indonesia continues to act as a key anchor in currency stability. Its proactive interventions and careful rate management throughout 2024 helped insulate the Rupiah from wider emerging market volatility. In 2025, markets will watch whether the central bank maintains its neutral-to-tight stance or begins to loosen in line with global peers. Communication will matter just as much as action — a clear forward guidance strategy can calm markets and limit overreactions. As the Rupiah forecast 2025 evolves, how Bank Indonesia positions itself in the second half of the year could determine whether the currency stays range-bound or breaks lower.

Rupiah Forecast 2025- Foreign Investment and Capital Flow Sensitivity

Source: NST.com

Indonesia has remained an attractive destination for long-term investment, especially in renewable energy, manufacturing, and digital infrastructure. But portfolio flows are far more sensitive. In 2025, any shift in sentiment — triggered by global shocks or local uncertainty — could quickly change the flow of funds in and out of Indonesian markets. The Rupiah, as with many emerging currencies, tends to react quickly to these moves. A surge in foreign bond sales or equity withdrawals can pressure the IDR in short bursts, even if macro indicators remain stable. This sensitivity to sentiment makes real-time communication and policy consistency even more crucial.

Comparing Regional Currencies: A Relative Advantage?

The emerging market currencies outlook 2025 shows that the IDR is holding up better than several of its peers. While the Turkish lira, Argentine peso, and South African rand remain highly volatile, the Rupiah has benefited from lower inflation, consistent growth, and relatively conservative debt levels. However, it is still grouped in the broader emerging market narrative — meaning it can face pressure during risk-off periods, regardless of local fundamentals. To outperform regionally, Indonesia must continue delivering policy discipline and avoid any surprises that could trigger investor skepticism.

Conclusion: Not a Crisis Year — But a Critical One

The Rupiah forecast 2025 doesn’t point toward a currency crisis — but it does underline the importance of strategic focus. Indonesia’s macro fundamentals remain largely intact, yet external variables — especially global rate cycles and trade flows — are hard to control. In this environment, the IDR’s performance may depend less on dramatic events, and more on how well Indonesia stays steady while the world moves around it. With consistent messaging, prudent fiscal policy, and a strong central bank presence, the Rupiah can hold its position. But investors and businesses should prepare for a year defined not by big swings, but by subtle turning points.