Why Traders in Asia Are Paying Attention to PROREX

In the world of forex trading, conversations often drift toward spreads, execution speed, or the reliability of a broker. Lately, PROREX has been part of those discussions in Asia, showing up in trading forums, classrooms, and even casual conversations among young investors. What draws attention is not a single feature but the mix of account choices, collective trading models, and the way technology like automation is entering the trading landscape.

Account Structures That Reflect Different Needs

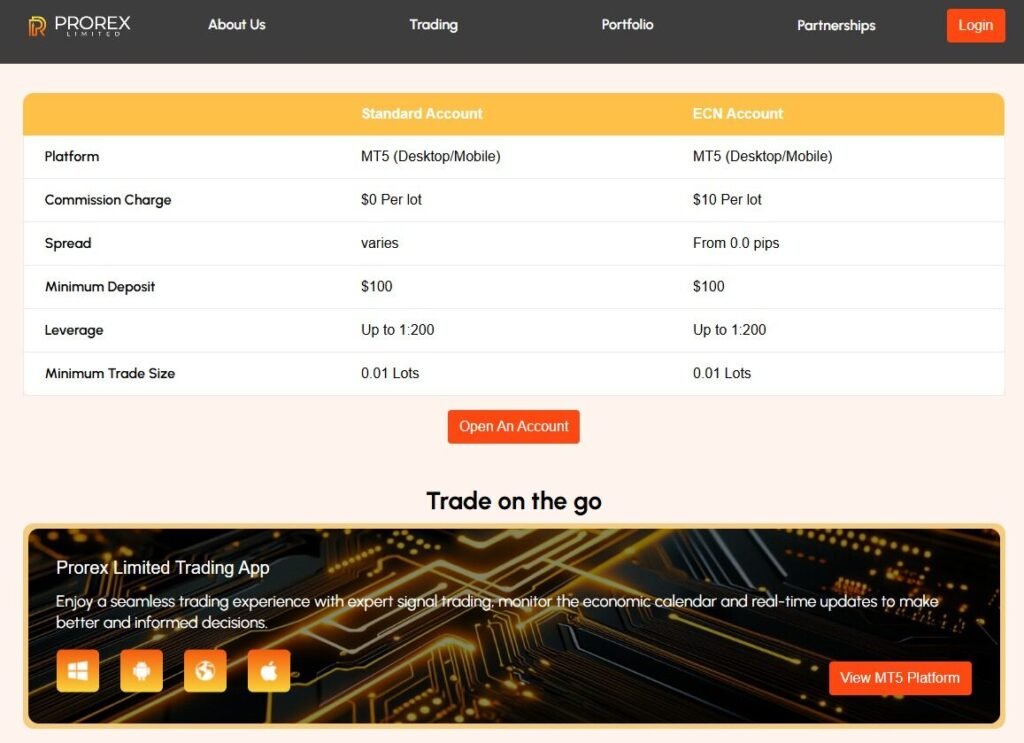

Every broker offers options, but the details often matter more than the headlines. With PROREX Asia, traders generally encounter two main account types: a Standard account with no commissions but variable spreads, and an ECN account that provides spreads as low as zero but charges a fixed commission per lot.

The difference between the two tells a larger story about the market. A beginner using a small account might feel more comfortable with the simplicity of the Standard setup, while a scalper running strategies on MetaTrader 5 may lean toward the precision of the ECN model. In this sense, the accounts mirror the diversity of trading styles present in the region.

PAMM, Copy Trading, and the Collective Experiment

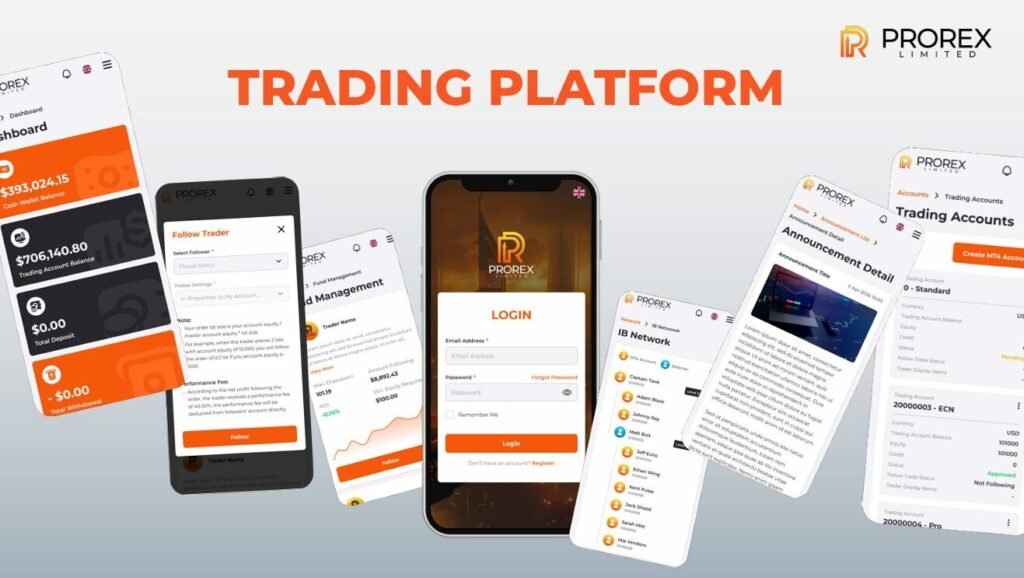

Another reason some traders mention PROREX is its PAMM trader program. PAMM (Percentage Allocation Management Module) allows investors to allocate funds to more experienced traders, with performance distributed proportionally. It’s one of several ways that collective trading is reshaping forex.

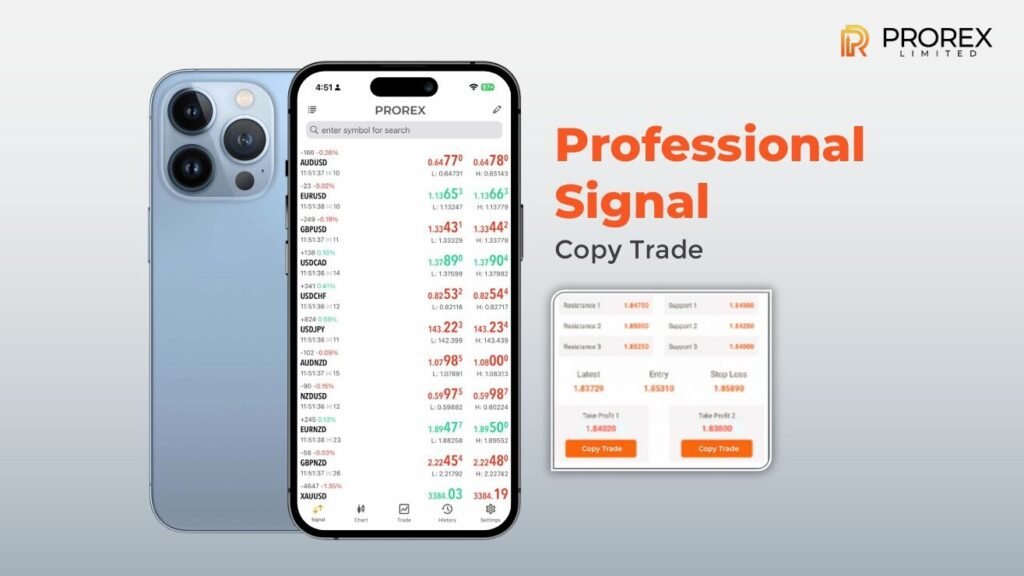

There’s also rising curiosity about Prorex copy trading, where users mirror the positions of others, and even the possibility of Prorex AI trading. Automation is a buzzword in financial markets, and while no system eliminates risk, the blending of AI and human judgment is shaping how people experiment with strategy. The appeal lies in having more choices, even if the outcomes remain uncertain.

Indicators, Strategies, and the Discipline of Rules

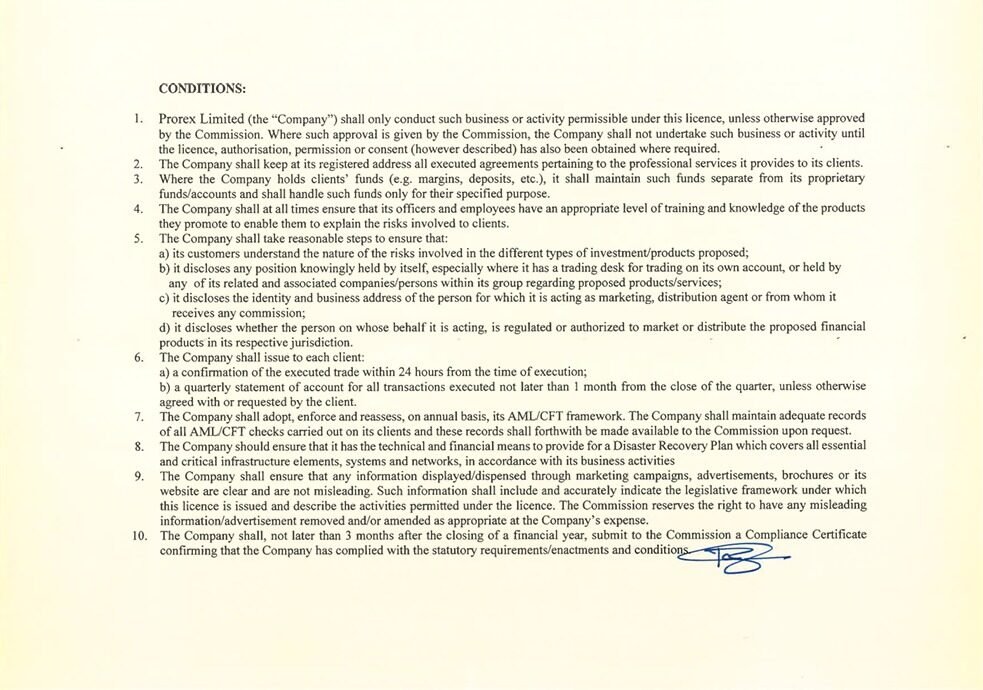

Tools like Prorex indicators are part of everyday trading discussions, but beyond strategies and signals, rules matter too. PROREX Product guidelines include restrictions against practices such as arbitrage between brokers, ultra-fast trading cycles, or attempts to exploit negative balance protection during high-volatility events.

These rules are not unique to one broker; they’re part of the framework that defines fair participation in the market. For many traders, understanding these boundaries is as important as spotting technical chart patterns.

Promotions and Revenue Models in Context

No overview would be complete without noting the presence of promotions like Prorex free credit or Prorex free bonus campaigns. Such offers often allow users to explore trading conditions under set requirements, like minimum lot trading or restrictions on hedging. Some see them as trial opportunities, while others view them as temporary boosts with limited long-term impact.

On the business side, the Prorex Revenue Share Program reflects how brokers build networks through partnerships and affiliates. This ecosystem of educators, community leaders, and introducing brokers forms part of the social layer of forex that often goes unnoticed outside the industry.

Low Spreads and the Human Side of Execution

For retail traders, technical terms like prorex low spread eventually come down to lived experiences: the speed of an order being filled, or the frustration when slippage alters an expected entry. A trader might plan to enter a position at a specific level, only to see execution happen a few pips away. At times this works in their favor, other times not. These small, human moments shape how platforms are perceived far more than glossy brochures.

A Note on Regulation

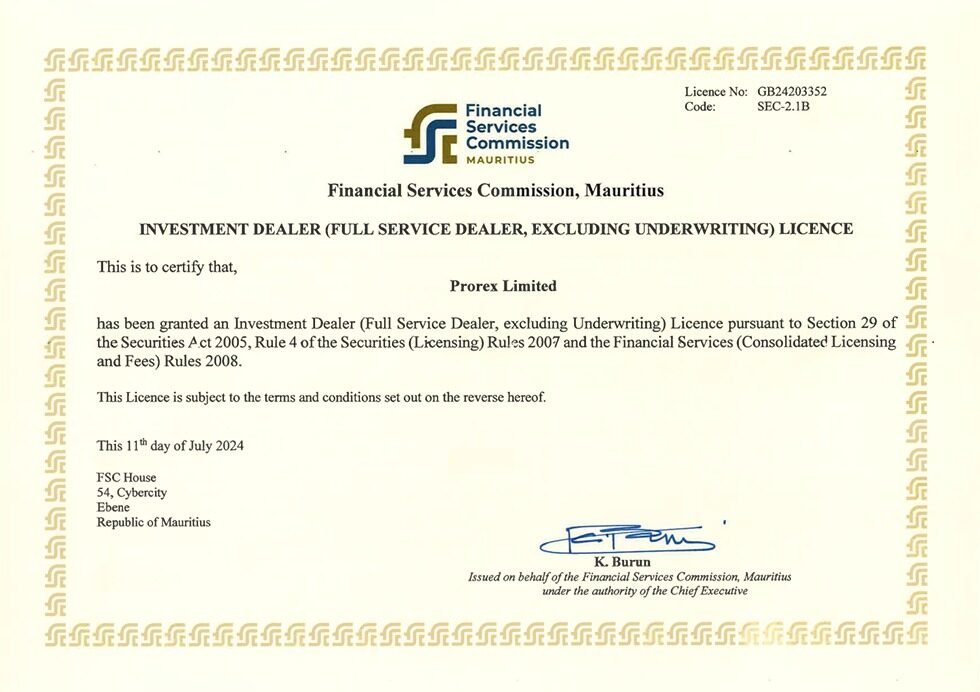

According to registration documents, Prorex Limited is incorporated in the Republic of Mauritius as an International Business Corporation under the Companies Act, with Certificate No: GB24203352. For observers, this provides context about the legal framework behind its operations. It also adding a layer of accountability in a sector where trust is always a central concern.

Conclusion

The reasons traders talk about PROREX are varied: account structures that cater to different levels of experience, collective tools like PAMM and copy trading, experiments with AI strategies, and the everyday realities of spreads and slippage. In the bigger picture, PROREX Asia represents how brokers adapt to a new generation of investors — individuals who are as interested in structure and security as they are in innovation and experimentation.

Official Website:Prorex Limited

General Support and Inquiries:Support@Prorex.Asia

Finance Inquiries:Finance@Prorex.Asia