Beginner’s Guide to Malaysia Stock Account Opening: Start Investing with Confidence

Starting Fresh: Why You’re Not Too Late to Begin Investing

If you’ve been thinking about putting your money to work, you’re not alone. Many Malaysians are turning to stocks as a way to grow their savings. But let’s face it — the first step, Malaysia stock account opening, can seem a bit intimidating at first.

Don’t worry — you don’t need a background in finance to get started. This guide is written for beginners, plain and simple. We’ll walk you through what a stock account is, how to open one, and what to expect along the way.

What Is a Stock Account and Why Should You Open One?

In simple terms, a stock account lets you buy shares of public companies — like the ones listed on Bursa Malaysia. When you own shares, you technically own a piece of that company.

So why open a stock account?

- Build Wealth Over Time: Investing in solid companies can grow your money over the years.

- Beat Inflation: Interest from savings accounts often doesn’t keep up with inflation.

- Earn Dividends: Some stocks pay you passive income just for holding them.

Think of it as giving your money a job.

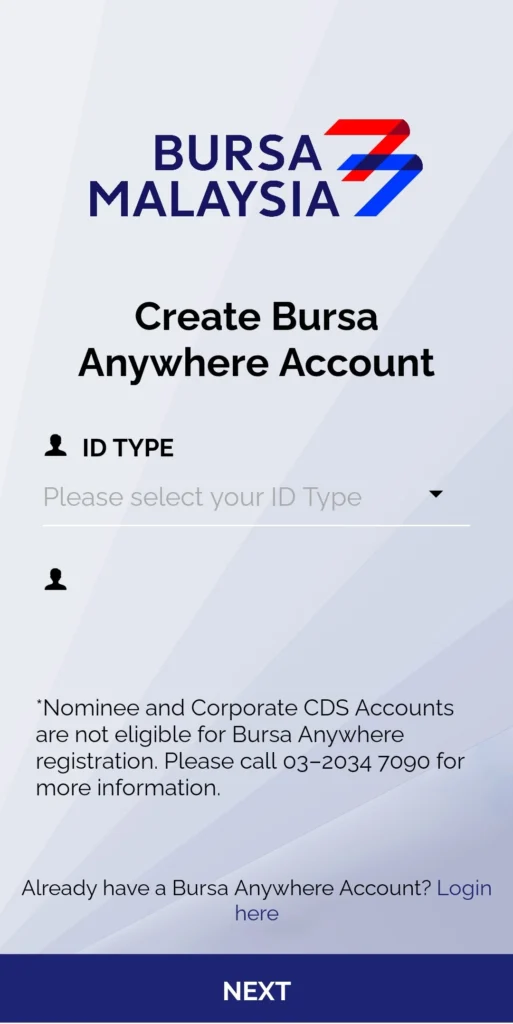

Types of Accounts You’ll Need

To start investing, you’ll need two accounts:

- CDS Account (Central Depository System): This is like a safety box that holds your stocks.

- Trading Account: This is what you use to buy and sell those stocks.

Both are typically opened at the same time through a broker.

Malaysia Stock Account Opening: What You Need to Prepare

Opening a stock account is simpler than it sounds — but you’ll need to have a few things ready:

- NRIC (if you’re Malaysian) or Passport + Visa (for foreigners)

- Proof of address — recent utility bill or official statement

- Bank account information

- Some brokers may also ask for income details (especially for margin trading)

Most brokers let you open an account online now. Rakuten Trade, CIMB, Maybank — all offer digital options. Pick what feels most user-friendly to you.

Choosing the Right Broker for Malaysia Stock Account Opening

Your broker is like your guide in the investing world. Choose wisely. Here are some beginner-friendly features to look for:

| What to Look For | Why It Matters |

|---|---|

| Low Fees | Keeps costs low while you’re learning |

| User-Friendly App | Makes it easier to understand and execute trades |

| Helpful Customer Support | Great when you hit a bump in the process |

| Market Tools | Research features can guide smarter decisions |

Take time to compare brokers — some are better for hands-on beginners, others suit DIY investors.

How Long Does Malaysia Stock Account Opening Take?

Not long at all. Most applications are processed in 2 to 5 working days. If you’re using an online broker, the process could be even faster.

You’ll fill in a form, upload your documents, and possibly do a quick video call for identity verification. After approval, you’re ready to start investing.

Know the Costs: What You’ll Pay to Open and Use Your Account

Here’s the good news — the upfront costs are usually low.

- CDS account setup fee: Around RM10–RM20 (one-time)

- Brokerage commission: Varies per trade — can be fixed (like RM10) or a percentage

- Stamp duty & clearing fees: These are government-imposed — standard for all investors

No surprises here, but always read the fine print before agreeing to terms.

What Happens After Your Account Is Open?

Once your accounts are active, you’ll:

- Fund your trading account via online banking

- Choose stocks based on your interests or goals

- Place your first order (buying shares)

- Track your investments through your broker’s platform

It’s okay to start small. Maybe just RM100–RM500 to begin with. You’re learning, not racing.

Helpful Habits for First-Time Investors

Starting out? Here’s what can help you avoid rookie mistakes:

- Start slow — Don’t invest everything at once

- Avoid hype — Social media “hot tips” are risky

- Focus on big-picture goals — Not daily price changes

- Learn as you go — Every trade teaches something

Even the best investors started out with doubts. What matters is consistency, not perfection.

Final Thoughts: Taking the First Step with Malaysia Stock Account Opening

Opening your first stock account isn’t as scary as it seems. In fact, Malaysia stock account opening is now more beginner-friendly than ever. With digital platforms, low fees, and tons of learning resources, there’s really no better time to take that first step.

Your future investor-self will thank you for starting today — even if it’s just a baby step.

Relevent news: Here