The Diverging Paths of Currency Traders and Everyday Exchangers

In the current Indonesian financial landscape, “forex” no longer points to a single activity. The phrase Forex Indonesia now encapsulates two very different models: one driven by mobile apps and speculative digital trading, and the other rooted in physical counters that offer direct money exchange. Each caters to different user groups, behaviors, and financial intentions. Together, they reflect the evolving nature of how Indonesians handle — and think about — foreign currency.

What’s becoming clear is that while both models are growing, they are not converging. Instead, they are branching out to serve increasingly distinct roles in everyday financial life.

Forex Indonesia: The Rise of Online Forex Trading in Urban Indonesia

The expansion of digital access and fintech innovation has helped forex trading reach new segments of the Indonesian population. Young professionals, students, and digital entrepreneurs are turning to trading platforms that let them speculate on global currency pairs with just a few taps. These platforms, regulated by BAPPEBTI, offer features like real-time price charts, leverage, and mobile execution.

The appeal is not just financial, but also psychological. Trading offers the allure of autonomy, a sense of control over one’s own capital, and participation in global economic movements. Apps are gamified, onboarding is simple, and users can start with low deposits. These conditions are accelerating participation, especially in major cities like Jakarta, Bandung, and Surabaya.

However, this ease of entry often masks the complexity beneath. Forex trading is inherently volatile, and many new users face steep learning curves. Still, the trend is clear: digital forex trading is carving out a firm presence in the Forex Indonesia space.

Forex Indonesia: Meanwhile, Money Changers Maintain Everyday Relevance

Source: Alamy

On the other side of the spectrum are the traditional money changers. Tucked into malls, airports, and business zones, they serve tourists, overseas workers, students studying abroad, and small businesses. The core value here is tangibility — customers see, touch, and walk away with the currency they need.

In contrast to the high-speed dynamics of forex trading, money changers offer stability. The rates are fixed for the day, clearly posted, and usually adjusted to include the operator’s margin. Transactions are straightforward. You bring your rupiah, get a rate, complete the deal, and leave with foreign notes in hand. For many, that clarity is worth more than the tiny rate differences found elsewhere.

Money changers in Indonesia are regulated by Bank Indonesia, and their role remains essential, especially in communities where trust in digital finance is still developing. While their services may not be glamorous or modern, they are efficient, safe, and rooted in decades of use.

Forex Indonesia: One Term, Two Purposes: The Functional Divide

Source: Adaremit

The most noticeable shift in Forex Indonesia is not technological — it’s psychological. Users no longer think of forex as a single solution. Instead, they recognize that forex trading and money changing meet very different goals.

Forex trading is about opportunity, investment, and risk. It appeals to those with a future-focused mindset, often tied to financial independence or capital growth. On the other hand, money changers serve present-focused needs — travel, payments, logistics. The user doesn’t care about charts or trends. They just need currency in hand.

This divide is growing, and rather than compete, each model appears to be finding its niche. As a result, the Indonesian foreign exchange ecosystem is becoming more layered, offering more tailored services to more distinct user segments.

What Drives User Choice?

Source: pdhpe

Consumer behavior in this space is influenced by a mix of trust, awareness, and utility. For example, someone in Denpasar exchanging IDR for JPY for a holiday will likely choose a reputable money changer because it’s immediate and practical. That same person may be completely uninterested in price fluctuations or interbank spreads.

Conversely, a university graduate in Jakarta with access to a trading community might be drawn to the dynamic nature of online forex. Their decision-making is based on news, market speculation, or algorithmic tools. They’re not looking to buy actual dollars — they’re trading trends.

Ultimately, these choices are not just about price or technology, but about personal goals and comfort with risk. Both trading and money exchange are valid. They’re just suited for very different kinds of users within Forex Indonesia.

Exchange Rates and Expectations

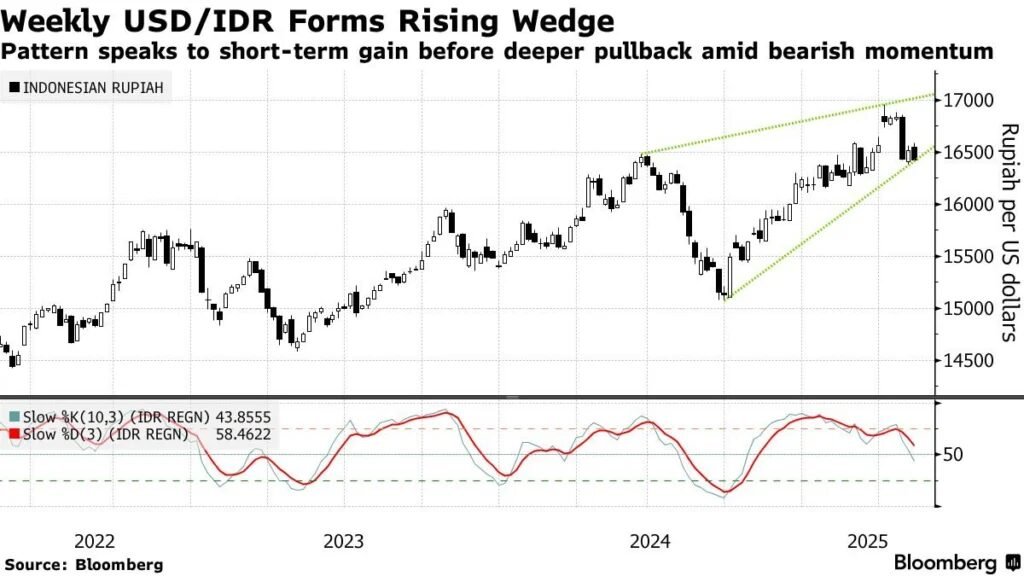

Source: Bloomberg

The mechanics of exchange rates also differ between the two models. Forex trading platforms reflect real-time global rates — often the same ones used by banks and institutions. But trading isn’t free. There are spreads, commissions, and sometimes overnight fees depending on the platform and broker.

Money changers, meanwhile, use daily posted rates that include their margin. These rates may not be as precise, but they offer predictability. The customer knows exactly what they’re getting. That certainty is often more valuable than chasing the tightest spread — especially when the transaction is for a fixed personal need.

Both models provide transparency in their own way. But each speaks to a different kind of user expectation in the Forex Indonesia context.

Legitimacy and Oversight: What Keeps Both Systems Running

Source: Pasardana

Indonesia’s dual regulatory framework ensures both services remain reliable. BAPPEBTI oversees digital forex brokers and enforces strict licensing rules to protect online traders from scams and illegal operators. Their website provides an updated list of approved brokers — something all users are encouraged to check before trading.

On the money changer side, Bank Indonesia provides oversight through a registration system and transaction monitoring rules. Licensed money changers must provide receipts, follow anti-money laundering guidelines, and post official rates.

As forex-related scams increase across Asia, Indonesia’s insistence on regulation is a strength — and a necessary one to keep trust in the Forex Indonesia sector intact.

Looking Ahead: Parallel Growth Paths

Going forward, it’s likely that digital forex trading and physical money changing will not merge — but will instead continue growing in parallel. Trading will innovate with new tools, automation, and AI-driven insights, attracting users looking to engage with global markets. Money changers will remain rooted in the physical economy, evolving with customer service enhancements and better rate transparency.

Rather than see this as a conflict, it’s better viewed as diversification. Forex Indonesia is no longer a single lane. It’s a multi-lane highway, with different on-ramps depending on where you’re headed.