Ethereum vs Bitcoin Singapore: A Practical Guide to Understanding the Shift

By 2025, Singapore’s crypto scene is no longer just about hype or headline prices. Instead, it’s about what works—and where. In the evolving landscape of Ethereum vs Bitcoin Singapore, Ethereum is steadily pulling ahead. Not because of louder marketing or celebrity endorsements, but because of its fit with the real-world needs of regulators, builders, and institutions. While Bitcoin remains iconic, Ethereum is becoming useful in ways that align more naturally with Singapore’s direction.

Let’s walk through why this shift is happening—step by step.

Step 1: Ethereum vs Bitcoin Singapore – Regulatory Support Comparison

To begin with, let’s look at regulation. In Singapore, MAS (Monetary Authority of Singapore) isn’t just observing the crypto space; instead, it’s actively experimenting with it. As a result, through MAS Project Guardian, Ethereum has emerged as the preferred infrastructure for tokenized assets and programmable finance pilots. Notably, this level of proactive engagement from regulators gives Ethereum a clear edge in this region.

Why not Bitcoin? Its design makes it reliable for value transfer, but not programmable. Ethereum’s flexibility, especially with its smart contract framework, allows it to integrate compliance logic—crucial in a city like Singapore where tech must fit within policy frameworks.

Step 2: Ethereum vs Bitcoin Singapore – ESG Considerations in 2025

After the Ethereum Merge impact, Ethereum switched to proof-of-stake, drastically cutting energy consumption. That matters a lot in Singapore, where ESG crypto investing isn’t just branding—it’s a business requirement.

Bitcoin’s proof-of-work still faces resistance in institutional settings due to its energy use. Until major breakthroughs in sustainable mining become mainstream, Ethereum continues to have the upper hand in ESG compliance.

Step 3: Real-World Smart Contract Use Cases

Created By bloxbytes

This isn’t about NFTs anymore. In fact, Ethereum smart contracts Singapore are increasingly embedded in legal agreements, powering tokenized real estate experiments, and even enabling early carbon credit pilots. So instead of staying theoretical, these smart contracts are showing up in live environments—right now, in Singapore.

So, if you want to enforce who can purchase a token, limit transfers per wallet, and build in anti-money laundering checks, you’ll need a smart contract layer. That’s where Ethereum steps in. By contrast, Bitcoin simply doesn’t offer the same built-in programmability.

Step 4: Ethereum vs Bitcoin Singapore – Tokenization Takes the Lead

Created By medium

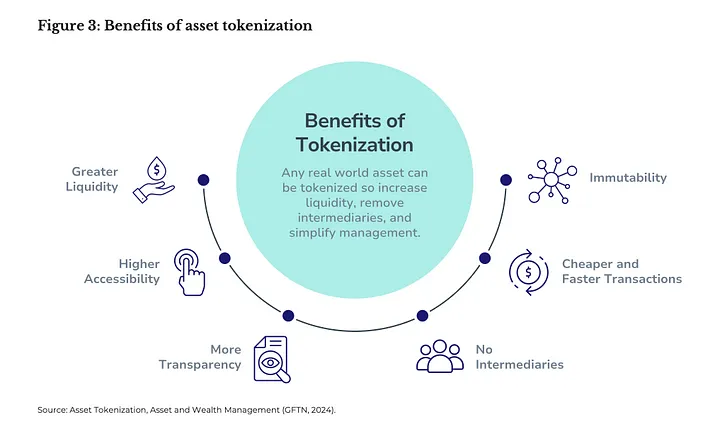

Tokenization in Singapore has moved from hype to infrastructure. Institutions are launching testbeds for digital bonds, private equity, and real estate—all built on Ethereum standards like ERC-1400.

Could Bitcoin participate? Technically yes, through additional layers. But those workarounds aren’t being picked by Singaporean pilots, where compliance and modularity matter more than theory.

Step 5: Developer & Adoption Trends

Go to a blockchain hackathon in Singapore and look around. Most prototypes are Ethereum-based. The crypto adoption Singapore ecosystem—from Web3 wallets to payment APIs—leans Ethereum.

That doesn’t make Bitcoin irrelevant. It remains the standard bearer for digital gold. But when developers want to build, Ethereum is where they start.

Final Thoughts: Ethereum vs Bitcoin Singapore Isn’t About Maximalism

It’s about fit. Bitcoin still plays a crucial role in wealth preservation, especially for long-term holders. But Ethereum? It’s the chain Singapore is using to build the future.

From ESG alignment to regulatory pilots and programmable asset design, Ethereum has checked boxes that Bitcoin hasn’t. That’s why, in the Ethereum vs Bitcoin Singapore conversation, Ethereum is currently leading the way—quietly but clearly.