Day Trading vs Swing Trading in Indonesia: Which Style Works for You in 2025?

Day Trading Indonesia: Day trading continues to grow in Indonesia as more traders gain access to online platforms and global markets. This method revolves around making rapid trades within the same day to capitalize on short-term market movements. For those who enjoy fast decisions and thrive in a fast-paced environment, day trading can be incredibly rewarding. With platforms offering real-time price data and low spreads, Indonesians now find it easier to trade forex pairs, indices, and even crypto during active market hours. However, the speed comes at a cost. It requires full attention, precise execution, and a willingness to deal with intense emotional swings multiple times a day. For many, it’s more than a strategy — it’s a full-time commitment.

Swing Trading: A Balanced Approach for the Strategic Investor

Swing trading offers an appealing alternative to those who prefer a more thoughtful and less stressful trading style. This approach involves holding positions over several days or weeks, capturing medium-term market moves. In Indonesia, swing trading is popular among professionals and students who can’t monitor charts all day but still want meaningful exposure to the market. It allows traders to spend more time on analysis and less time reacting. Tools like moving averages, RSI, and price patterns are widely used, and trades are often placed at night or on weekends after careful review. For traders with patience and a steady mindset, swing trading provides both flexibility and the potential for strong returns with lower stress.

Lifestyle and Time Commitment: Which Style Fits Your Schedule?

Source: XS.com

One of the biggest factors influencing trading style in Indonesia is how much time you can realistically dedicate to the markets. Day trading demands availability during key market sessions — often overlapping with working hours or late evenings. It’s a game of speed and timing. Swing trading, on the other hand, offers more breathing room. Traders can evaluate setups once or twice a day and still stay competitive. This makes swing trading a favorite among part-time traders or those with full-time jobs. With mobile trading apps and scheduled alerts, Indonesian swing traders can stay active in the markets without being chained to a desk.

Emotional and Psychological Demands

Source: iStock

The emotional aspect of trading often gets overlooked, but it can determine long-term success. Day trading requires intense focus, quick reactions, and the ability to handle constant decision-making. Losses and wins happen quickly, and the psychological rollercoaster can be draining. In contrast, swing trading usually involves fewer trades and less pressure to make split-second decisions. This reduces emotional fatigue and allows for more deliberate risk management. For Indonesians new to trading, swing trading might be a more manageable entry point to avoid burnout while building confidence and skill.

Comparing Profitability and Risk

Source: Dreamstime

Profit potential exists in both day and swing trading, but the way you earn differs. Day traders in Indonesia typically aim for smaller profits on high-frequency trades, requiring strong accuracy and discipline. Swing traders look for larger price movements, taking fewer trades but potentially gaining more per position. This distinction also affects risk. Day trading can be riskier due to rapid market shifts and overtrading, while swing trading benefits from wider stop-loss placements and more thoughtful planning. Risk-to-reward strategies can work for both styles, but managing exposure is crucial either way.

What Are Indonesian Traders Trading?

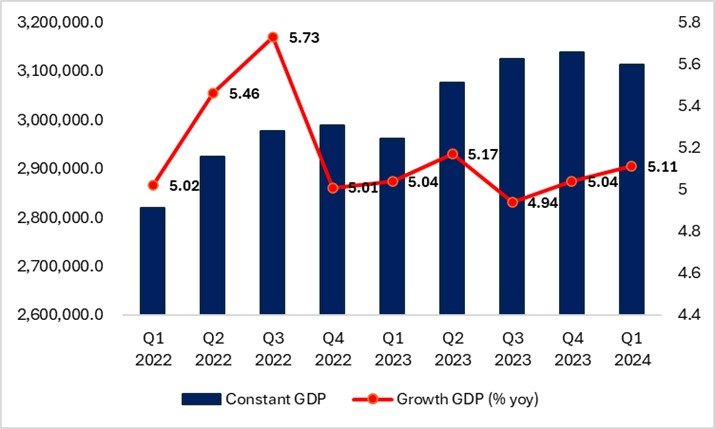

Source: Macroeconomic Dashboard

In 2025, Indonesian traders are more diversified than ever. Many day traders focus on forex pairs like USD/JPY or EUR/USD during peak volatility, often using tight spreads and rapid execution tools. Swing traders may analyze broader economic trends, wait for momentum shifts, and rely on longer timeframes. Assets like gold (XAU/USD), crypto pairs, and major indices are increasingly popular among swing traders. The growth of fintech in Indonesia means more tools, analysis platforms, and broker services are available than ever before, supporting a wide range of strategies across both styles.

Day Trading Indonesia: Understanding Your Trading Personality

Choosing between day trading and swing trading often comes down to self-awareness. Are you naturally quick-thinking and comfortable with fast changes? Or do you prefer taking your time and planning ahead? Day trading appeals to the energetic and risk-tolerant. Swing trading is ideal for those who value patience and structured thinking. In Indonesia’s evolving trading landscape, understanding your own preferences, stress thresholds, and time constraints can help guide you to a strategy that feels sustainable. The most successful traders often choose the approach that matches their inner rhythm, not just market trends.

Day Trading Indonesia: Try Both Before You Decide

No strategy works for everyone — which is why trying both styles in a demo or small live account can be beneficial. Test the speed and emotion of day trading alongside the pacing and analysis of swing trading. See which one fits your routine, your mindset, and your performance. In Indonesia’s 2025 trading environment, there’s flexibility to switch, adapt, or even combine strategies depending on the market. Some traders blend both, scalping during major news events and swinging positions during quieter weeks.

Conclusion: Day Trading Indonesia- It’s About Fit, Not Just Results

The question isn’t which is better — day trading or swing trading — but which is better for you. In Indonesia, where the trading community continues to grow, traders have more tools and education available than ever. Whether you choose the adrenaline of day trading or the rhythm of swing trading, success comes from consistency, emotional discipline, and a style that matches your goals. Start small, learn from experience, and evolve your strategy over time — 2025 is a great year to find your fit.