Crypto Cards vs Credit Cards: One’s the Future, One’s the System — Which Side Are You On?

Crypto Card Comparison Isn’t Just Buzz — It’s a Tension Between Two Worlds

Crypto card comparison: the whole crypto card vs credit card debate isn’t just about payments. It’s about control, identity, and (maybe) sticking it to the old financial system.

I mean, when was the last time your credit card rewarded you with something that actually appreciates in value? Oh right—never. That’s part of why people are diving into this whole “crypto card comparison” discussion.

But is all the crypto card hype justified? Or is it just flashy marketing over actual substance? Let’s talk about it—no jargon, no fluff.

Crypto Cards: Freedom or Fragility?

So, crypto cards… What are they really?

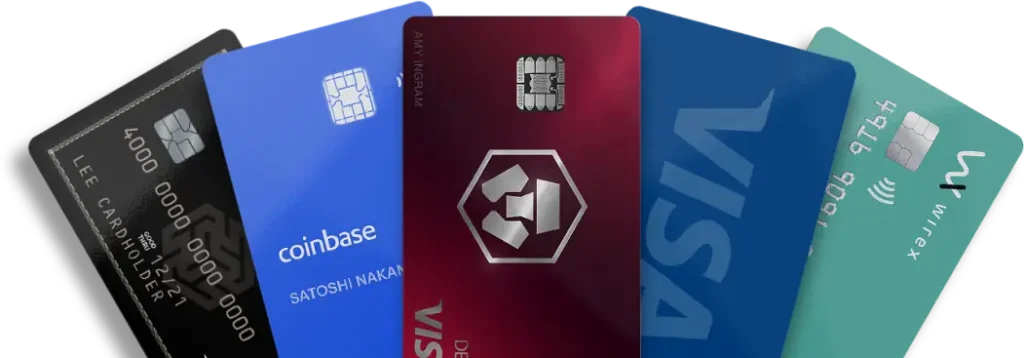

At a glance, they seem awesome. Spend your crypto directly at stores? Feels kind of revolutionary. Platforms like Binance, Crypto.com, or Wirex promise you can live off your Bitcoin without cashing out first. Swipe, spend, done.

And yes, they technically work like prepaid cards—your crypto is converted to fiat in real time. No loans, no credit lines, no banks peeking into your business.

That freedom? It’s addictive.

But don’t ignore the catch: fees can sneak up on you. Exchange rates fluctuate. And if the market tanks mid-lunch? Well, congrats—you just bought a sandwich for $75 (kind of).

The Crypto Card Comparison: What’s Actually Good?

Let’s give credit where it’s due (pun intended). Crypto cards do come with some cool perks:

- Cashback in Bitcoin – Some give 2%, 3%, even 5% back in crypto. That’s huge… if the market goes up. If it crashes? Not so much.

- No Middleman Bank – For the anti-establishment crowd, this is a big win.

- Global Usability – Most are Visa or Mastercard-backed, so you’re not locked out abroad.

- Sleek Branding – Admit it. Crypto cards look cooler. It’s like having a tech badge in your wallet.

But let’s be real—these are not one-size-fits-all tools. They favor people already deep into the crypto world, not folks just looking to buy groceries.

Old School Credit Cards: Boring? Maybe. Effective? Absolutely.

Now, credit cards may feel like financial dinosaurs, but guess what? Dinosaurs ruled the Earth for a reason.

Here’s why credit cards are still relevant—even smart:

- They Build Credit – Crypto cards? Not a chance. Your traditional card reports to bureaus and helps you grow your financial reputation.

- They Protect You – Fraud protection, chargebacks, purchase insurance… these aren’t just perks, they’re lifesavers.

- They Reward Stability – Airline miles, hotel points, rotating bonuses—it’s not exciting, but it’s reliable.

- They Let You Breathe – Grace periods, minimum payments, and float time can be helpful in real life. Crypto cards? Pay now or don’t pay at all.

Let’s not forget: you don’t lose money holding USD in a credit card account if the market drops 15% overnight. With crypto, well… yeah.

Crypto Card Comparison: Is There a Right Side?

Here’s where things get messy—and interesting.

If you’re the kind of person who’s already living crypto-first, then yes, a crypto card might make your life easier. You don’t need to convert your tokens back into fiat every time. You can spend directly, live lightly, and maybe even feel a little smug doing it.

But if you’re someone who values predictability, credit building, and well-established support systems, a traditional credit card is still your safest bet.

Honestly? Most of us probably live somewhere in the middle. Maybe we hold a little ETH, but we still like the backup of an Amex.

Final Thoughts on This Crypto Card Comparison

So, crypto cards vs credit cards—who wins?

Look, this isn’t Highlander. There doesn’t have to be only one.

Crypto cards are a bold experiment—maybe even the future—but they’re not foolproof. Credit cards, for all their faults, are stable, trusted, and built for scale.

Here’s the real takeaway: don’t buy into the hype blindly. And don’t cling to tradition just because it’s familiar. This crypto card comparison tells us that financial tools are evolving fast—and the smart move? Understand both worlds, then pick what works for you.

And if that means carrying both a Coinbase card and a Chase Sapphire in the same wallet? So be it.

Just… maybe don’t use them both on the same night out.

Relevent news: Here